In this week’s Money Metals Midweek Memo, host Mike Maharrey examines the post-election economic landscape following Donald Trump’s victory. He discusses how the financial markets have responded, the persistence of inflation, and the challenges of monetary policy. Maharrey also underscores the importance of precious metals as a hedge against economic instability, offering insights into what lies ahead.

Market Reactions to Trump’s Election

Financial markets reacted significantly to the election results. Stock markets experienced rallies as investors anticipated pro-business policies, including tax cuts and economic stimulus. The U.S. dollar surged, reflecting optimism about economic growth, while a bond selloff drove treasury yields higher. Precious metals, including gold and silver, initially saw sharp declines—a typical response under Republican administrations—but have since rebounded as inflation concerns remain at the top of mind.

- Stock Markets: Significant rallies occurred as investors anticipated potential pro-business policies, such as tax cuts and economic stimulus.

- Dollar Strength: The U.S. dollar surged, reflecting optimism about potential economic growth.

- Bond Market: A selloff caused treasury yields to rise.

- Precious Metals: Gold and silver saw sharp declines, typical during Republican leadership, but have rebounded slightly as inflation concerns persist.

Inflation: A Persistent Challenge

Maharrey highlighted inflation as a continuing issue that has far-reaching economic implications. Core inflation increased by 0.3% month-on-month, translating to an annualized rate of 3.6%, well above the Federal Reserve’s target of 2%. Since the COVID era, the dollar’s purchasing power has plummeted by over 20%, compounding the challenges for American consumers. Maharrey reiterated economist Milton Friedman’s assertion that inflation is driven by money printing, not economic activity.

- Core Inflation: Rose 0.3% month-on-month, equating to an annualized rate of 3.6%—far above the Federal Reserve’s 2% target.

- Dollar Devaluation: Since the COVID era, the dollar’s purchasing power has dropped by over 20%.

- Federal Reserve’s Role: Maharrey emphasized that inflation stems from money printing, not economic activity, citing economist Milton Friedman: “Inflation is always and everywhere a monetary phenomenon.”

Federal Reserve’s Policy Response

The Federal Reserve has adopted a cautious approach, recently cutting interest rates to 4.5–4.75%. While this is higher than the near-zero rates of the post-2008 financial crisis, it remains moderate by historical standards. Maharrey criticized the Fed for maintaining historically loose monetary conditions, noting that their policies have not effectively addressed inflation. Federal Reserve Chair Jerome Powell emphasized a data-dependent approach, leaving the door open for adjustments based on future economic conditions.

- Interest Rates: A recent cut brought rates to 4.5–4.75%, historically moderate but high compared to the post-2008 norm of near-zero rates.

- Monetary Policy: Maharrey criticized the Fed for failing to address underlying inflation, noting that financial conditions remain historically loose.

- Fed Chair Powell’s Outlook: Powell highlighted a data-dependent approach, signaling potential flexibility in future rate changes.

Structural Economic Issues

Maharrey warned that many of the economy’s structural problems are beyond the control of any president, including Trump. The U.S. paid over $1 trillion in interest on its national debt in fiscal 2024, highlighting the unsustainability of current fiscal policies. Federal spending surged 24% year-over-year in October 2024, driven by entitlements such as Social Security, Medicare, and National Defense. With only 27% of the federal budget classified as discretionary, significant spending cuts are difficult to achieve without addressing politically sensitive programs.

- Debt: The U.S. paid over $1 trillion in interest on national debt in fiscal 2024, showcasing the unsustainability of current policies.

- Spending Increases: Federal spending surged 24% year-over-year in October 2024, with entitlements like Social Security and Medicare accounting for the bulk.

- Limited Discretionary Spending: Only 27% of the budget is discretionary, leaving little room for significant cuts.

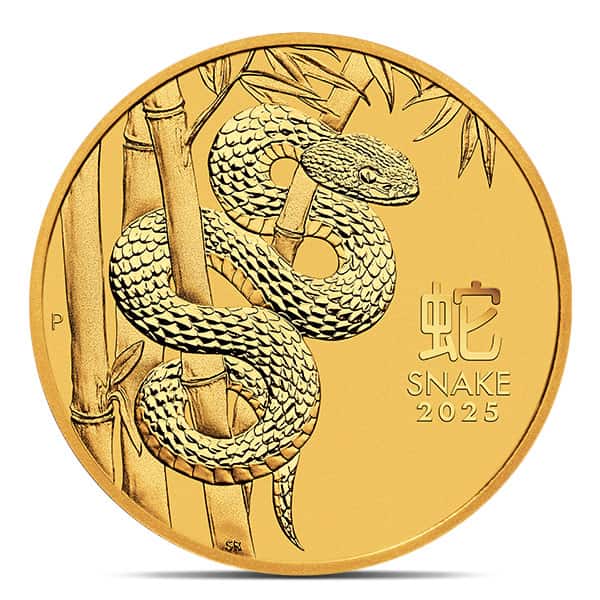

Precious Metals: A Timeless Hedge

Amid ongoing inflation and structural challenges, Maharrey emphasized the value of precious metals as a hedge against economic uncertainty. The Silver Institute projects industrial demand for silver to reach 1.21 billion ounces in 2024, leading to a fourth consecutive annual supply deficit. Maharrey also reaffirmed gold’s historical role as a hedge against inflation, describing the current price dips as an excellent buying opportunity for long-term investors.

- Silver Market Deficit: The Silver Institute projects industrial demand to hit 1.21 billion ounces in 2024, driving the fourth consecutive annual supply deficit.

- Gold as a Hedge: Maharrey reiterated gold’s historical role as a hedge against monetary debasement, viewing current price dips as a buying opportunity.

Managing Expectations

Maharrey urged listeners to temper their expectations for what any president can achieve, emphasizing that decades of poor fiscal and monetary policy have created systemic issues that no single administration can resolve. While Trump’s presidency may slow the growth of government spending, excessive debt, persistent deficits, and entrenched inflation remain formidable challenges.

For those seeking to protect their wealth, Maharrey recommended investing in precious metals through Money Metals Exchange, noting the company’s resources and customer support.

Learn More

To stay informed about economic trends and precious metals, subscribe to the Midweek Memo and Money Metals’ Market Podcast. Visit MoneyMetals.com to explore investment opportunities and access valuable resources.

Source: Money Metals

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Telegram, HIVE, Minds, MeWe, Twitter – X and Gab.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Post-Election Markets: Inflation, Debt, and the Case for Precious Metals"