By Tyler Durden

By Tyler Durden

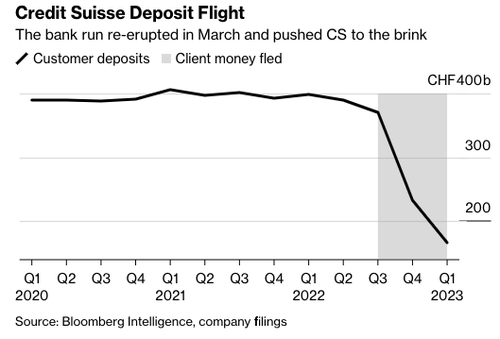

Credit Suisse reported Monday that clients had withdrawn 61.2 billion francs ($69 billion) in the first quarter and that outflows were continuing, highlighting the challenge faced by UBS in rescuing its rival in March.

In the last financial statement as an independent company, Credit Suisse reported a loss of 1.3 billion Swiss francs ($1.46 billion) for the first three months of the year. It said “significant net asset outflows” were seen in March.

Most asset outflows originated from its wealth management unit and occurred in all regions. The troubled bank said, “These outflows have moderated but have not yet reversed as of April 24, 2023.”

Credit Suisse’s wealth management unit lost 9% of assets in the first quarter. It said this would slash fees it generates and “likely lead to a substantial loss in wealth management” in the second quarter.

The Swiss government ultimately forced UBS’ $3.25 billion takeover of Credit Suisse last month, and carried significant integration risks. Both banks could see a continued exodus of customers.

High net worth investors started pulling money out of scandal-plagued Credit Suisse well before the turmoil unleashed in the regional US banking sector in March. Bloomberg said more than 200 billion francs of customer deposits over the last six months flowed out of the troubled bank.

The Ultimate Plan B Guide (Free Report)

“The magnitude of losses and outflows is alarming,” Keefe, Bruyette & Woods’ analysts wrote in a note to clients. They said, “The revenue trajectory is so damaged that the deal could well remain a drag on UBS operating results unless a deeper restructuring plan is announced.”

Also, in this morning’s announcement, Credit Suisse announced it had terminated a $175 million acquisition deal to purchase the investment bank of Michael Klein (the bank’s former director). The deal was supposed to be a plan to spin off Credit Suisse’s investment bank under the First Boston name that Klein would operate.

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "“Magnitude Of Losses And Outflows Is Alarming:” Credit Suisse Hemorrhages $69 Billion In Assets"