By Tyler Durden

By Tyler Durden

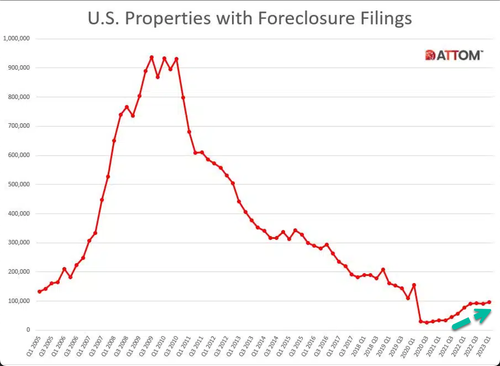

In the first quarter of this year, home foreclosures surged, as reported by property data firm Attom. Following a two-year lull, pandemic-related housing assistance programs are winding down. Homeowners who chose not to make mortgage payments are now either negotiating new terms with lenders, selling their properties, or, as current trends suggest, facing foreclosure. This troubling rise coincides with consumers falling behind on their credit card payments.

While still below pre-pandemic levels, foreclosure filings during the first quarter of 2023 totaled 95,712 properties, up 6% from the previous quarter and 22% from a year ago. This was the 23rd consecutive month with a year-over-year increase in foreclosure activity.

“Despite efforts made by government agencies and policymakers to try and reduce foreclosure rates, we are seeing an upward trend in foreclosure activity,” Rob Barber, CEO at ATTOM, said in a statement. He continued:

“This unfortunate trend can be attributed to a variety of factors, such as rising unemployment rates, foreclosure filings making their way through the pipeline after two years of government intervention, and other ongoing economic challenges. However, with many homeowners still having significant home equity, that may help in keeping increased levels of foreclosure activity at bay.”

Much of Attom’s data was recorded before Silicon Valley Bank’s demise. A credit crunch followed and sparked further busting of the tech bubble that added capital destruction in private equity and venture capital firms. Now real-estate investments, primarily commercial real estate, are being significantly reevaluated as more financial stress is boiling up.

The Ultimate Plan B Guide (Free Report)

Making matters worse is 24 months of negative real-wage growth for consumers who’ve maxed out credit cards and drained personal savings. Lower-tier consumers are coming under pressure as big banks are beginning to notice a startling uptrend in credit-card and loan-payment delinquencies.

“We’ve seen some consumer financial health trends gradually weakening from a year ago,” Wells Fargo Chief Financial Officer Mike Santomassimo said on an earnings call last Friday.

Banks have tightened their lending standards ahead of expected turmoil among consumers.

Wells Fargo set aside $1.2 billion in the first quarter to cover potential loan losses.

Bank of America provisioned $931 million for credit losses in the quarter, much higher than the $30 million a year prior but below the fourth quarter $1.1 billion provision.

JPMorgan more than doubled the amount it set aside for credit losses in the first quarter from a year earlier to $2.3 billion, reflecting net charge-offs of $1.1 billion. –Epoch Times

UBS analysts led by Erika Najarian believes mounting macroeconomic headwinds would lead to “credit deterioration throughout 2023 and 2024 with losses eventually surpassing pre-pandemic levels given an oncoming recession.”

Najarian said loan defaults are forecast to stay “below the peaks experienced in prior downturns.”

However, we’re noticing that consumers are buckling under financial pressure—an ominous sign of trouble ahead.

Top image: SHTFplan

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Home Foreclosures And Missed Credit Card Payments Surge As Consumers Buckle"