By Blake Lovell

By Blake Lovell

‘Our Alliance does not want to abolish physical cash,’ cries the opening gambit on the website ‘BetterThanCash.org’. It is a UN body, ostensibly pursuing the UN Sustainable Development Goal of ‘financial inclusion’. But it dovetails with a wider phenomenon, the disappearance of physical cash from the economy.

They are an alliance of nation states, corporations and NGOs. They meet under the aegis of the United Nations Capital for Development program (UNCFD). They number about 80 members, of varying influence, ranging from the small states of Equatorial Guinea and the Solomon Islands up to heavyweight global corporates like Unilever and Coca-Cola. They also receive significant funding from the Bill and Melinda Gates Foundation, USAID and Visa Inc.

Their moniker, ‘Better Than Cash,’ will ring alarm bells for some who retreat from the digitisation of money. But for many it exemplifies a trend of the last decade. There has been a move away from using cash for day-to-day transactions in wealthy countries. As payment rails have become slicker, electronic transactions have become commonplace. Since the advent of electronic banking in the 1980s, there have been developments in technology which allow the quick communication in banking necessary to fulfil over-the-counter transactions.

When one pays for a bag of flour in the UK for example, using ‘contactless’, what they really are doing is scanning their RFID chipped card onto the shop’s card reader. The reader decodes the bank account details and submits them to the payment provider, usually a middle man like Visa or Mastercard. That provider than runs a check with the customer’s bank, to see if they have adequate funds to cover the transaction. The provider will then pay the bill, and make a demand or reservation from the customer’s bank. The shop owner will have received the payment, and the provider, Visa or Mastercard, will submit a demand for payment from the customer’s bank. This can take up to three full days to finalise. Yet, the transaction at the till can take mere seconds because of this complex layering of institutions and technology.

Now, I have laid out this summary of a ‘contactless’ transaction for two reasons. Firstly, it is to illuminate what to many people is a murky situation. Many millions of people in the UK will use such methods in their day-to-day lives without looking at the nuts and bolts under the hood of the transaction. I believe that it is something of a duty to educate people on the ins and outs of banking in order to better protect people from the more nefarious activities carried out in the financial world. But, secondly, and more pertinent to this article, I used this summary to highlight the complexity of the modern retail banking system. Further to this point, it is very difficult to achieve this system in many of the countries that are in the ‘Better Than Cash’ alliance. Where there is little technological infrastructure, it can be hard to provide a stable system of payment technology. Where there is less prevalence of bank account usage, there is less incentive for a shop owner to invest in said technology. For example, Papua New Guinea, a member of the Better Than Cash Alliance, has about 85% of its population in rural areas with no access to formal financial services, and an estimated 15% of the population have access in some way to the internet. Here, as in many of the less affluent countries of the world, Cash is King.

The Case Against Cash

Now let us examine the case against cash. If the UN, Coca-Cola and Bill Gates all agree that there needs to be a system Better Than Cash, there must be some problems with cash. Well let us take the sentence from the aforementioned website:

“It also means that governments, companies and international organizations can make and receive payments in a cheaper, safer and more transparent way”

This implies 3 weaknesses of cash: That it is more expensive to use, that it is unsafe or dangerous, and that it is opaque and un-transparent.

Easiest way to get your first Bitcoin (Ad)

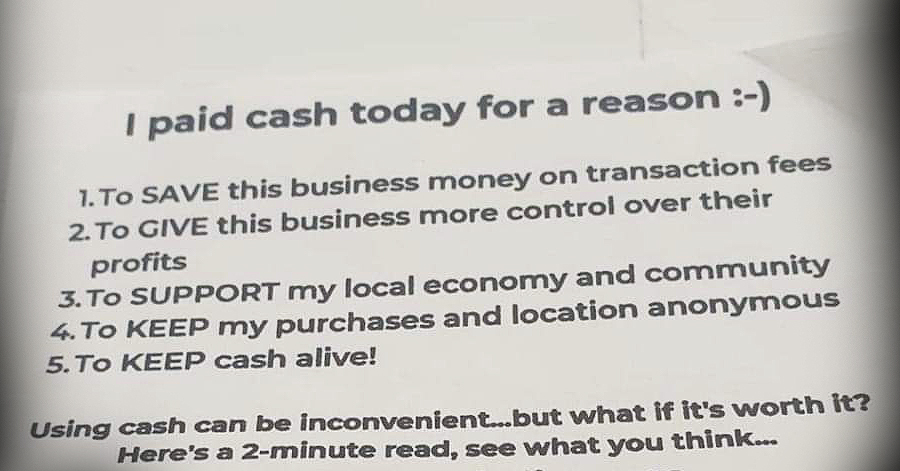

The first of these is its expense. It seems to be the weakest of the arguments, as a cash transaction hand to hand does not cost anything. Likewise, it is one of the cheaper ways to interact with a bank, who will often not charge to make a cash deposit. There is a cost associated with the handling of cash, counting and transporting cash securely. Counter to this, though, is the cost of digital transactions. I can cite numerous small businesses in my local area with signs up saying ‘Cash Preferred’ due to the extortionate charges put in place by middlemen like Visa or Mastercard. They will often lose a percentage cut of every transaction. The local butcher, for example, had a bumper Christmas but was then met by a bumper bill from their payment provider. As it is an old-school business, they had factored in all of the costs of running the shop, paying for goods, etc. but had not factored in such a huge fee, having only recently adopted a new card reader. Another store, like many others, has a minimum card spend. For a similar reason, a charge for £1 of goods may cost £1.50 to process with the digitised banking system. Thus, the UN-backed body’s argument about cheapness must be based on some unclear factor which they do not disclose.

The first of these is its expense. It seems to be the weakest of the arguments, as a cash transaction hand to hand does not cost anything. Likewise, it is one of the cheaper ways to interact with a bank, who will often not charge to make a cash deposit. There is a cost associated with the handling of cash, counting and transporting cash securely. Counter to this, though, is the cost of digital transactions. I can cite numerous small businesses in my local area with signs up saying ‘Cash Preferred’ due to the extortionate charges put in place by middlemen like Visa or Mastercard. They will often lose a percentage cut of every transaction. The local butcher, for example, had a bumper Christmas but was then met by a bumper bill from their payment provider. As it is an old-school business, they had factored in all of the costs of running the shop, paying for goods, etc. but had not factored in such a huge fee, having only recently adopted a new card reader. Another store, like many others, has a minimum card spend. For a similar reason, a charge for £1 of goods may cost £1.50 to process with the digitised banking system. Thus, the UN-backed body’s argument about cheapness must be based on some unclear factor which they do not disclose.

The second argument has more validity. The use of cash can carry some inherent risk. As cash is a physical asset, it must be held, carried and transacted in person. This could put the spender or receiver under threat, particularly in areas with less security, policing and higher crime. If one is carrying a sum of cash, or a shopkeeper has a till full of earnings, they are a target for crime. Here one could build some case for the safety argument of digital monetary systems.

The final argument posited is about transparency, or the lack of it. It is probably one of the most common critiques of cash from institutions – that it can facilitate crime, or even worse, terrorism, by din of it being untraceable. A criminal could transact for illicit goods and services outside of the purview of regulators by using cash, as opposed to surveilled systems of digital money. Now, there have been studies into this topic, but by its nature it is hard to pin down for certain statistics – as a crime that goes without being caught in the act does not make it into statistics. However, Europol, the unified institution for crime and policing in the EU, puts a conservative estimate that 1.5 billion euros are detected or confiscated by authorities in the EU each year. This is a phenomenally small sum for a continent the size of Europe – notwithstanding the huge discrepancy of how much crime is successful in evading official seizure or detection. Furthermore, we can take the received opinion of Professor Friedrich Schneider that a full ban on cash would not significantly dent levels of crime.

Professor Friedrich Schneider, one of the most renowned experts in the areas of the shadow economy and tax evasion in Europe, concluded that a cash ban would reduce crime by a mere 10% and organized crime by less than 5%.

An interesting case study to note here is the case of Sweden. They have, through instituting many anti-cash policies, reduced their cash usage from the EU average of 11-12% in 2009 to about 2% or less today. This is perhaps in response to a series of high-profile cash thefts in the country, culminating in the infamous Västberga helicopter robbery. There was a concerted campaign after this, particularly from trade unions, to sideline the use of cash in favour of digital methods. Even though the policy has been successful in reducing crime of cash-theft, it has, admits the Swedish Central Bank, led to an increase in digital-money crime, such as fraud. Although, they show that it is not excessively high and remains at the European average.

I myself have some critiques of cash to add, but they are more heterodox; that is, outside of the mainstream school of economic thought. Firstly, I would point to the fact that cash is the paper and metal form of fiat currency. That is to say central banks can mint some amount of currency each year. Currencies used to be tied to real-world assets like gold. But since the de-pegging of currencies in the 1970s, there is technically no limit to the amount that a central bank can print and therefore dilute the supply of money. The more they print, the less it’s worth. Whilst we still rely on the issuance of currency from the nation state and their concurrent central bank, we are at the mercy of their whims in terms of finance.

Gold and Silver: Industry-Best Customer Service at Money Metals (Ad)

Secondly, as issuance is centrally controlled, it can be the victim of failed policy. I take as example the case of the Central African Franc, which is used by an estimated 160 million people across 14 Central African states, many of whom are in the ‘Better Than Cash’ program. The CFA franc is a colonial hangover instituted by France in 1945 and retained after the broader independence movement in 1960s Africa. It is still controlled by France, its disbursement is decided by the French treasury and there is parity with the Euro. This means at any point the CFA Franc can be exchanged into Euros and out again at 1:1. However, this causes many problems and much friction. Why should African states, which are on paper independent of their colonial overlords, still have their financial policy dictated from the former imperial power? It is an unresolved issue that still rears up, in 2019 the 5 star movement in Italy accused France of neo-colonialism through their use of the CFA Franc and argue that the economic instability caused by French policy causes significant migration flows into Italy. The most relevant factor for our debate about cash though comes from the day-to-day use of the CFA Franc in West Africa. As the notes can be traded 1:1 for Euros, France has to be very tight-fisted when it comes to minting new notes as that could affect the value of the euro as a whole. Yet, as the African states are clearly viewed as inferior in priority, it is they who have to suffer. So few notes are minted in countries like the Central African Republic that it is common practice to get your change as an IOU signed by the business owner. You would pay for your cup of tea with a 50 CFA Franc note, and receive a piece of paper saying 45 CFA francs with a date and signature. It is then up to the citizen to either redeem, or try and pass on these IOUs at a later date. In this instance, cash has failed due to the post-colonial policy of France, but illustrates one of the pitfalls of centrally controlled currencies – particularly in volatile monetary environments such as those found in the ‘developing world.’

The Case For Cash

I will make no bones about the fact that I see a plethora of policies emerging from international financial institutions seeking to diminish the use of cash. I believe that there is a concerted effort to do this to a certain end: control. We can and will continue making arguments for and against cash, but the general narrative that cash is bad and digital money is good serves primarily the economic powers that already exist. A digital system of currency is much easier for a central authority to surveil and control. As currency is one of the main cogs that allows the functioning of the modern industrial economy, it makes sense it is a target for institutional regulation. When an institution seeks to control something, it is out of self-interest. Thus I give short shrift to the arguments that are presented as humanitarian when they involve financial control of the victim, sorry recipient of aid or assistance.

That being said, let us examine a couple of arguments for cash. Firstly, as I alluded to above, it allows some measure of independence from institutional control. As of now, no institution has a chip in the banknote, although the technology does exist and the Bill and Melinda Gates Foundation has put money into promoting the concept of ‘smart banknotes’. Yet cash is still free to be transacted, which is a massive freedom for the people. One can trade a good or service for cash, thus retaining some value and then transact that cash for another good or service later without being constrained, censored or unjustly restricted as a result. I caveat this with the argument made above that cash, as fiat currency is vulnerable to the whims of central-bank policy. However, day-to-day cash suffices as a good means of exchange outside of institutional control. Here I mention again, institutions as it is, not just the nation state that seeks to control the population.

Other groups may seek to exert control for other reasons. One nascent trend is for banks to limit and control their account holders funds for various reasons; Canadian banks, for example, froze the assets of hundreds of accounts who were associated with widespread anti-government Canandian Truckers’ protests in 2020 and 2021.

Aside from using the control of payment gateways to enforcing a political agenda, nother emergent trend is for banks to lead the charge on environmentalism with their championing of ESG – Environmental Social Governance – a broad framework of pro-business, anti-carbon policies. We can extrapolate forward a point in the not-too-distant future where banks will be policing the carbon ‘cost’ of a customer’s purchases and potentially limiting or blocking transactions if the user is too ‘carbon intensive’. In this schema of tighter control and regulation, cash is a pressure valve to carry out the activities which may be suddenly deemed illegal or unpalatable yet are necessary for society to continue.

Let us hear directly from the horse’s mouth. The central bank of the EU, the ECB, launched a report in response to the declining use of cash during the coronavirus hysteria. They noted a decline in cash usage where people were paranoid about transmission on currency, yet the WHO maintains ‘There is currently no evidence to confirm or disprove that COVID-19 virus can be transmitted through coins or banknotes’. It was one of the most impactful events on cash usage in recent memory; in the EU cash preference dropped a number of percentage points. The second most impactful event, we note, was an increase in cash usage following the disastrous 2008/9 global financial crisis (often referred to in banking literature by the handy acronym GFC). People had lost faith in banks and decided that holding their own cash was a good idea if retail banks were likely to go insolvent. This is reflected in the passage buried in the ECB report:

Cash is still the only form of public money that is directly accessible to all citizens, ensuring autonomy, privacy and social inclusion. As a strategic response to various developments having an impact on the availability and acceptance of cash, the ECB adopted a 2030 strategy with the vision to preserve euro cash as a generally available, attractive, reliable and competitive payment instrument and a store of value of choice.

They acknowledge the power of cash as a transactional medium and store of value. I guess we can rest safe in the knowledge that they have a ‘strategy with the vision to preserve euro cash’ until at least 2030. So we have maybe 7 more years of cash being available from European banks to look forward to.

As a sidenote, see this directive from the European Comission in 2016 saying that ‘Payments in cash are widely used in the financing of terrorist activities… In this context, the relevance of potential upper limits to cash payments could also be explored’. Here we have the old threat of terrorism being used to limit cash transactions, without much evidence by way of demonstrating the utility of cash for ‘terrorism’. Yet the anti-cash legislation rolls on unabated, passing into the EU acquis.

Another facet of this increasing regulation is the movement for CBDCs: Central Bank Digital Currencies. These take all of the bad parts of centrally controlled systems – bad actors having too much power, central policy being dictated by the few vested interests and a pursuit of power for power’s sake – and apply those to a currency. As is would be distributed by a central bank there is no retail bank to do the control of loans, there is no private intermediary to interact with. One would have an account with the State, who would distribute or restrict the currency as they see fit. I often tie this idea in with the nefarious social-credit system that is blossoming in China and eyed enviously by power-hungry elites the world over. Hereby, any activity that the State deems as wrongful can be actively policed by restricting the citizen. If there is only a CBDC system for finance, then your money could be turned off, your financial interactions can all be monitored, you can be controlled to a huge degree, which is a dictator’s wet dream — total control over the mind and body of its population. That is an impulse we must in my view resist. It leads to the decline of the human condition and eventually leads to catastrophes and great harm. The policy is sold with such meagre pittances as ‘making day-to-day transactions easier’, but the road is being paved towards a city of panopticon surveillance and total control that is, in essence, subjugation. In these terms, cash is one outlet for freedom to be asserted, and hence why I believe it is under the crosshairs of central controllers the world over.

Thus let us return to this alliance, the ‘Better Than Cash’ group. Note that they are by no means the prime mover in the anti-cash movement. At best they are a talking shop or useful pawns for the real power brokers. Yet they present us an inroad into the often nebulous and unclear high-policies of international institutions and offer us a leaping-off point into the discussion.

I mention real power brokers and perhaps something can be gleaned from the CV of the leader and progenitor of the ‘Better Than Cash’ Alliance, Dr Goodwin-Groen:

Dr. Goodwin-Groen also advised leading organizations in the field of financial inclusion including the Consultative Group to Assist the Poor, World Bank Group, Soros Foundation, UK Department for International Development…

So, the person who created the alliance and is the name and face of the movement also worked for: 1) The World Bank, who control the debt obligations of nation states, keeping poor states mired in debt whilst their resources are plundered and play a part, alongside the Bank for International Settlements in dicatating global financial policy. 2) The Soros Foundation, widely seen as a politically destructive force dressed in philanthropic garb. Linked to colour revolutions across Eastern Europe, fomenting civil unrest in the USA and exerting political control over European elections. 3) DFID, the UK’s Department for International Development, which opens up international aid to private interests and acts as the business arm for the UK’s military and intelligence industries after the recent merger with the Foreign Office. In sum, she has the résumé of someone who works with big power institutions to broker deals which usually turn out badly for the everyday citizens of countries. So I, myself, have reservations that her initiative is to do with inclusivity and helping out the poor, and more to do with the usual neo-colonial exertion of power and exploitation for material gain. But that’s only my opinion.

We’ve also mentioned the involvement of Coca-Cola, who repackage water, sugar and aspartame to great profit, and Unilever who like to monopolise food and health products the world over. But we shouldn’t ignore in our critique of the ‘Better Cash Alliance’ the UNCFD. As with any UN body there is some corruption, usually stemming from the large swaths of funding being sent from Brussels or New York down to bureaucrats in nation-state management positions. As the money is garnered in a sidelong way from the populations through their governments, there is sometimes a failure of oversight. In the UNCFD there is documented widespread fraudulent use of funds in Somalia and Somaliland. This independent research article found that the UN exerts significant political control in Somalia and Somaliland, and that UNCFD funds are routinely used to curry political favour, rather than as the aid for which it was originally intended. They report that their investigation was even hampered by UNICEF and that their reportage of fraud fell on deaf ears.

Now this is one case of many, but it represents a trend that I think most will understand as existing inside the UN framework. This is not to say that institutions within the UN are rotten to the core; I assume that many people who work for UN bodies have the best of intentions, and that many achieve good things in global and local politics. But it goes to show that the more we investigate the badges of approval that the ‘Better Than Cash’ Alliance proudly show us on their website, are not so clear cut. We could go through each of their claims, too, and dispute them but that would fill another long-form article and to no great avail. I charge you to look at the claims and sources for yourself on betterthancash.org and see how easily they can spuriously present a claim about digital-money systems based on a piece of research that has little to do with the actual claim at all. In fact, the Alliance doesn’t propose anything new in their promotion of digital payments. They simply re-vivify the commonplace methods of RFID cards and QR codes and jazz it up with the inclusion of dystopian biometric IDs which ‘include fingerprints, hand geometry, earlobe geometry, retina and iris patterns, voice waves, DNA, and signatures.’ Nothing creepy about that.

As I have mentioned, the ‘Better Than Cash’ alliance is a mere minnow in the seas of political influence, but as one researches these topics the same conclusion emerges: flashy projects that look good on a website, are presented by well-funded international institutions to provide cover for their real agendas. Happy-looking Africans using a smart phone are pushed to the fore of a campaign and a nice-looking statistic about how many women are empowered by a project make up the headline. But when we dig into the membership, the foundations and origins of these schemes, they often have the same few groups, corporations and financial institutions backing it. It is something of a humanitarian shield for vested interest to carry out their malicious activities behind.

Here we have presented a debate on the fundamental case for and against cash. But it is couched in the international narratives and historical trends which we should not ignore. “As we rush to reap the benefits of digital payments” as the sister organisation to ‘Better Than Cash’ says, we should not let real political debate fall by the wayside. In my opinion, to do so allows the laying of permanent payment rails of control. And that once the railway is laid, it will be hard for the world’s poorest to change track. It is not only through cash that we and they can assert their freedom. But the War on Cash is something that we should dig into and bear in our minds when we are assessing economic affairs.

To end, I will balance the opening quote with one in 2017 from the CEO of Visa, another foundational partner of the ‘Better Than Cash’ Initiative:

We’re focused on putting cash out of business.

The war on cash is on.

***

READ MORE CASHLESS SOCEITY NEWS AT: 21st Century Wire Cashless Society Files

ALSO JOIN OUR TELEGRAM CHANNEL

PLEASE HELP SUPPORT 21st CENTURY WIRE’S MEDIA PLATFORM HERE

Source: 21st Century Wire

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "The War on Cash is Here"