By Tyler Durden

By Tyler Durden

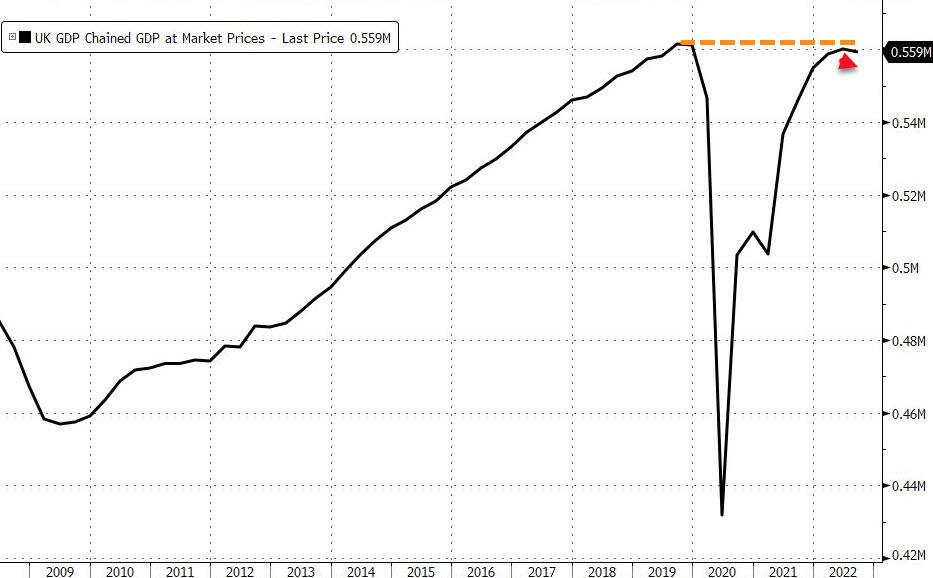

Britain’s Office for National Statistics (ONS) on Friday said the nation’s economy contracted 0.2% in the July-September period, the first quarterly contraction in over a year.

Commenting on the GDP data, Chancellor Jeremy Hunt said:

I am under no illusion that there is a tough road ahead — one which will require extremely difficult decisions to restore confidence and economic stability.

The 0.2% contraction in the UK contrasts with the 0.2% expansion seen across the EU.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the UK economy had slipped to the back of the G7 pack again, “beset by more intense headwinds from fiscal and monetary policy, and substantial long-term supply-side damage from Covid and Brexit”.

Additionally, ONS said that GDP fell 0.6% between August and September (worse then expected), reportedly impacted in part by businesses closing for the funeral of Queen Elizabeth II.

Finance spokeswoman for the main opposition Labour party described the third-quarter GDP numbers as “extremely worrying”.

As well as a recession, Britain is facing a cost-of-living crisis with UK inflation at a four-decade high above 10 percent, screaming ‘stagflation‘ – the central bankers’ nemesis.

In the quarter, real household expenditure fell 0.5% and output in consumer-facing services fell 0.8%. There were also widespread declines across most manufacturing industries.

Sanjay Raja, economist at Deutsche Bank, said the GDP contraction in the third quarter was the result of “continued weakness in household and business confidence, higher inflation and higher interest rates in the economy”.

The Ultimate Guide to Frugal Living: Save Money, Plan Ahead, Pay Off Debt & Live Well

The Ultimate Guide to Frugal Living: Save Money, Plan Ahead, Pay Off Debt & Live Well

But it gets worse…

As Bloomberg reports, Britain’s real estate sector recorded its worst return in more than 13 years in the third quarter of 2022 after a sharp rise in borrowing costs weighed on the industry.

The MSCI UK Quarterly Property Index, which tracks retail, office, industrial and residential property, plunged by 4.3% in the three months through September.

That’s the worst performance since the second quarter of 2009, according to research published by MSCI.

“The evaporation of property’s yield premium — amid the recent deteriorating macroeconomic outlook and rising inflation and interest rates — weighed on performance,” Niel Harmse, a senior associate in MSCI’s global real estate research team, wrote in the report.

All of this suggests that UK’s already “miserable” Misery Index is set to soar higher – worse than at any time in the last 30 years…

Finally, we note that this ugly data data comes ahead of the Conservative government’s crucial budget announcement next week aimed at bringing much-needed economic and political stability to Britain.

Source: ZeroHedge

Top image: Pixabay

Charts: Bloomberg

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "UK “Misery” To Worsen As Economy Shrinks More Than Expected In September"