By Tyler Durden

By Tyler Durden

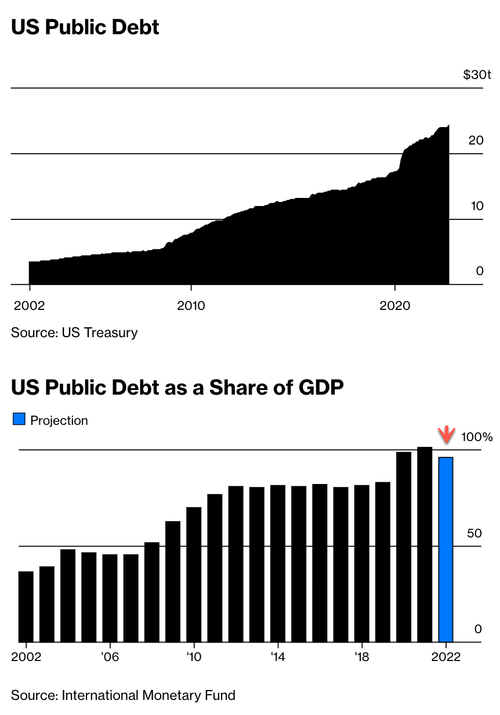

A high debt-to-GDP level and over $30 trillion in public debt have become a massive problem and a political hot potato in Washington.

It appears the Biden administration and the Federal Reserve have chosen the route to inflate away some of the debt racked up during the virus pandemic.

High inflation rates (currently like what we see today) can reduce the real value of debt, allowing governments to, in effect, pay off debts using money worth less than when they originally borrowed it.

Bloomberg pointed out that “one of its most surprising direct offshoots” of rising inflation has “largely gone unnoticed: U.S. government debt is shrinking rapidly.”

But it’s not in dollar terms. It’s measured against the inflated size of the economy.

There’s a challenging trade-off through inflating the debt away, which is the government’s gain at the lender’s expense. This means bondholders will be repaid by the government much less than they initially put up.

So, while inflation makes old debt more manageable for the government to service, it also makes new debt more expensive; and inflating the debt away comes with other consequences.

Easiest way to get your first Bitcoin (Ad)

If investors, businesses and households expect higher inflation, it could lead to a doom loop of soaring inflation expectations.

Ricardo Reis, a professor at the London School of Economics, recently told NPR News in an interview that over the last century, “hyperinflation” started when “governments have such a large debt pile that they found themselves unable to collect the taxes to pay for it, resorted to inflation …”

“This is pretty much every hyperinflation the world has experienced in the last 100 years, with only a few exceptions. Almost every hyperinflation was the result of a government having such a large debt that they found themselves unable to collect the taxes to pay for it, resorted to inflation, and that started a spiral that led to the whole value of the debt certainly going to zero with hyperinflation, but also the government being completely unable to borrow at all and, in the process, destroying its economy.”

In a more recent interview, Matthew Piepenburg, Commercial Director at Matterhorn Asset Management, told Kitco News:

Yet rate hikes are “disingenuous” since the Fed has no intention of fighting inflation, Piepenburg claims.

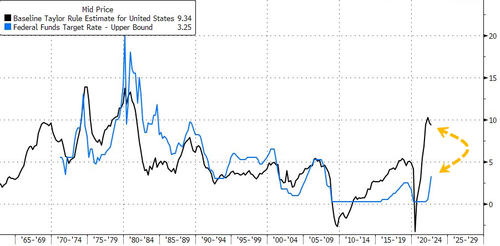

“When you’ve got 8 to 9 percent CPI inflation, you’re not going to fight that with a 4 percent, 3 percent, or even 5 percent Fed Funds Rate, which we can’t even afford,” he explained. “The truth is that the Fed, like most central banks throughout history, wants inflation to be higher than interest rates.”

He suggested that the U.S. is a “debt-soaked nation who has its back against the wall,” and would reduce the Fed Funds Rate to “inflate away its debt.”

“I think Powell is seeking inflation,” said Piepenburg. “The only reason they’re raising rates today is not to fight inflation. It’s so they’ll have some [reason] to cut [rates] when the real recession becomes an official recession.”

Based on the current rate of unemployment and inflation, the Taylor Rule suggests Fed Funds should be over 9%.

The fact that Fed Funds is nowhere near where the rule states may suggest Piepenburg could be right about the Fed’s intentions to inflate away government debt.

Gold and Silver: Industry-Best Customer Service at Money Metals (Ad)

Listen to Piepenburg’s full interview here:

So shrinking pandemic debt may seem like a solution for the government and Federal Reserve, but if history is any guide, this could lead to even more economic problems.

Source: ZeroHedge

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "US Inflates Debt Away After Historic Pandemic Binge; Comes At Risk"