By Tyler Durden

By Tyler Durden

While the world has been obsessively focused on crude oil and gasoline in recent weeks, we instead alerted readers to a far more dire scenario playing out in diesel, a source of energy which is absolutely critical in keeping the “just in time” world running on time.

As a reminder, here are some of the articles we have published on the topic in recent weeks, many even before the Ukraine war:

- Diesel Is The U.S. Economy’s Inflation Canary – Feb 8

- U.S. Diesel Stocks Set To Fall Critically Low – Feb 18

- China Asks State-Owned Refiners To Halt Gasoline, Diesel Exports – Mar 10

- Global Diesel Shortage Raises Risk Of Even Greater Oil Price Spike – Mar 12

Fast-forward to today, when our warning was echoed by the heads of one of the largest commodity trading houses and the biggest independent oil trader who were speaking at the FT Commodities Global Summit in Lausanne, Switzerland on Tuesday.

The corporate leaders estimated that as much as 3 million barrels of oil and its products a day could be lost from Russia as a result of sanctions, in line with previous estimates, and warned that global markets face a squeeze on diesel with Europe most at risk of a “systemic” shortage that could lead to fuel rationing.

“The thing that everybody’s concerned about will be diesel supplies. Europe imports about half of its diesel from Russia and about half of its diesel from the Middle East,” said Russell Hardy, chief of Switzerland-based oil trader Vitol. “That systemic shortfall of diesel is there.”

Those imports mean that Russian supplies account for about 15% of Europe’s diesel consumption, according to the FT which carried their comments.

Hardy said the shift to more diesel consumption over gasoline in Europe had helped to create shortages of the fuel. He added that refineries could boost their diesel output in response to higher prices at the expense of other oil-derived products to shore up supply, but warned that rationing was a possibility.

Torbjorn Tornqvist, co-founder and chair of Geneva-headquartered Gunvor Group, added: “Diesel is not just a European problem; this is a global problem. It really is.”

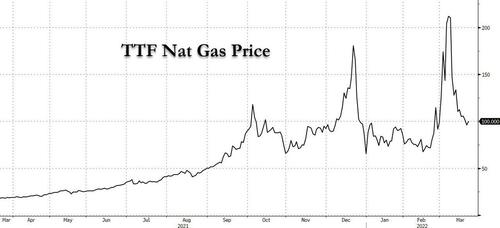

Tornqvist also warned that European gas markets were no longer functioning properly as traders faced huge demands from banks for cash to cover hedging positions. “I think it’s broken. It really is,” he said. “I never thought that somebody could say ‘ah, gas has fallen below 100 per megawatt hours is really cheap’.”

Gas futures linked to TTF, Europe’s wholesale gas price have swung from about €70 a megawatt hour before Russia’s invasion of Ukraine to about €230 two weeks ago and then slid below €100 this week. Before May 2021, European gas prices were below €20 a megawatt hour.

As noted last week, Europe’s largest energy traders called on governments and central banks to provide emergency liquidity support to keep gas and power markets functioning as sharp price moves triggered by the Ukraine crisis have strained commodity markets. Hardy said that to move a cargo equivalent to 1 megawatt hour of liquefied natural gas priced at €97, traders must provide €80 in cash, straining their capital requirements.

Worse, confirming that Europe faces an even colder winter, Tornqvist said European utilities would struggle to fill gas storage for next winter given the “paralysed” state of the spot market for gas unless policymakers stepped in to provide guarantees to protect buyers against price swings.

But going back to diesel, Bloomberg’s Javier Blas tweeted a handful of the scariest quotes from the energy CEOs at today’s FT commodities summit:

- Trafigura CEO Jeremy Weir: “The diesel market is extremely tight. It’s going to get tighter and will probably lead into stock outs,” referring to when fuel stations run dry.

- Gunvor CEO: “Europe is so short of diesel.”

- Vitol CEO: “The thing that everybody’s concerned about will be diesel supplies.”

Needless to say, without diesel, not only will traffic in Europe grind to a halt, but much if not all US truck-based logistical support and supply chains will soon be paralyzed. The consequences for the global economy will be dire.

Source: ZeroHedge

Image: Pixabay

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "“Gas Stations Will Run Dry”: Catastrophic Scenario For Diesel Emerging According To World’s Biggest Energy Traders"