By Tyler Durden

By Tyler Durden

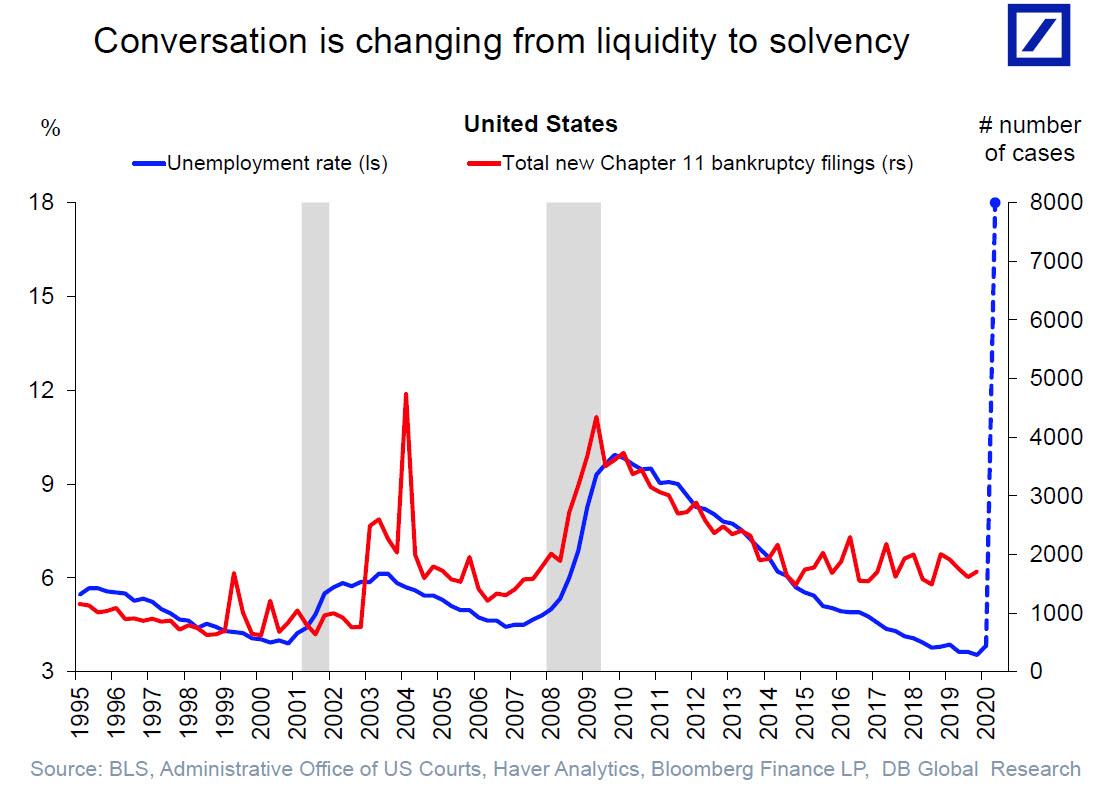

One month ago, when showing the uncanny correlation between defaults and the unemployment rates, we predicted that the number of Chapter 11 filings that is about to flood the US will be nothing short of biblical.

All that was missing was a catalyst; one which according to Bloomberg arrived in late May as retail landlords started sending out thousands of default notices to tenants, who in turn experienced a collapse in foot traffic, sales and cash flow due to the COVID-19 pandemic, and were simply unable to pay their debt obligations.

According to Bloomberg, restaurants, department stores, apparel merchants and specialty chains have been receiving notices from landlords – some of whom have gone as long as three months without receiving rent.

“The default letters from landlords are flying out the door,” said Andy Graiser, co-president of commercial real estate company, A&G Real Estate Partners. “It’s creating a real fear in the marketplace.”

Pressure from default notices and follow-up actions like locking up stores or terminating leases was cited in the bankruptcies of Modell’s Sporting Goods and Stage Stores Inc. Many chains stopped paying rent after the pandemic shuttered most U.S. stores, gambling that they could hold on to some cash before landlords demanded payment.

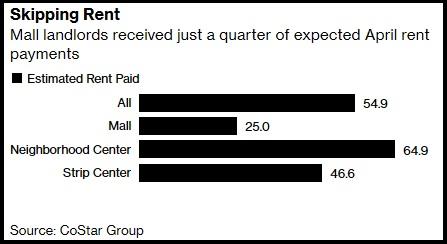

An estimated $7.4 billion in rent for April hasn’t been paid (May numbers have yet to be released), or about 45% of what’s owed, according to a recent analysis by CoStar Group, which also found that just a quarter of of expected rent payments have been received by landlords.

“If the landlords don’t put a pause on their actions, you’re going to see more bankruptcies.”

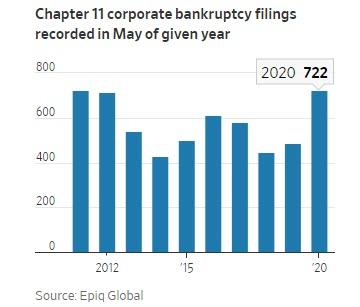

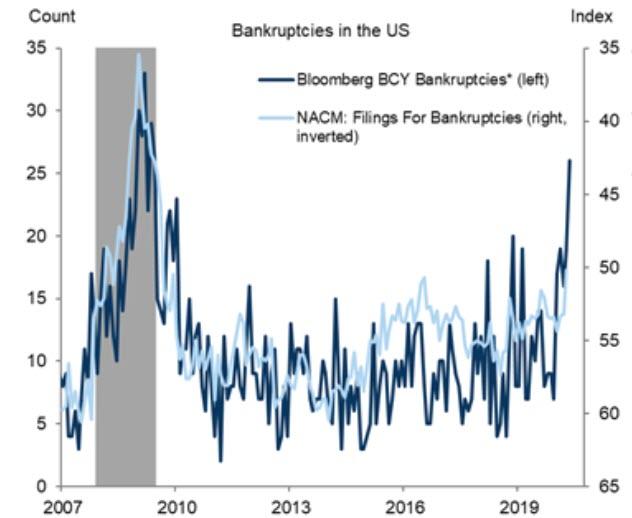

Last Thursday, these anecdotal reports were confirmed by the American Bankruptcy Institute which announced that as expected, corporate bankruptcies soared during May, pushing the number of filings to levels recorded in the wake of the 2007-09 recession. According to figures from legal-services firm Epiq Global, US bankruptcy courts recorded 722 businesses nationwide filing for chapter 11 protection last month, a yearly increase of 48% from 487 businesses in May of 2019. The surge was also seen on a month-over-month basis, which jumped by 28% from the 562 Chapter 11 filings in April.

See: 177 Different Ways to Generate Extra Income

The number of corporate bankruptcies in May was the highest since May 2011, when the great financial crisis was still impacting corporate viability.

In addition to numerous small and medium business, several iconic companies also filed for bankruptcy last month, including retailers J.C. Penney, Neiman Marcus and J.Crew along with the management company behind two leading Lasik surgery brands, the U.S. division of Le Pain Quotidien, Gold’s Gym and drugmaker Akorn.

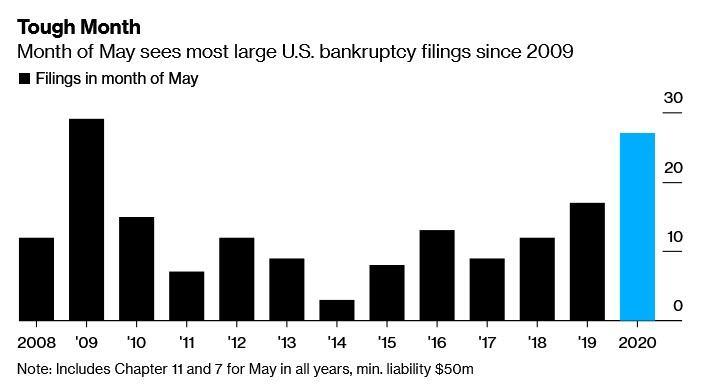

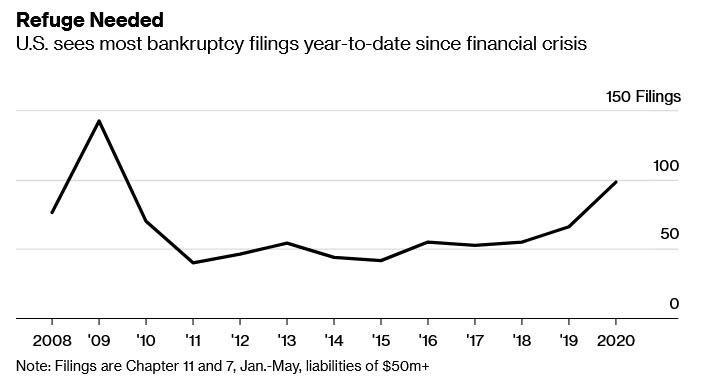

According to a separate report from Bloomberg, in May alone, some 27 companies reporting at least $50 million in liabilities sought court protection from creditors – the highest number since the Great Recession.

In May 2009, 29 major companies filed for bankruptcy, according to data compiled by Bloomberg. And year-to-date, there have been 98 bankruptcies filed by companies with at least $50 million in liabilities – also the highest since 2009, when 142 companies filed in the first four months.

A recent analysis from Goldman Sachs also found that the number of bankruptcy filings is now the highest since the financial crisis.

The spike in filings – a consequences of the coronavirus shutdowns which swept the economy over the past three months – comes after a period of historic expansion for the U.S. economy, which had led to a lull for the corporate restructuring industry. Some legal experts have gone so far as to call for Congress to increase the number of bankruptcy judges to ease the potential workload.

Deborah Williamson, a San Antonio bankruptcy lawyer with Dykema Gossett PLLC, said that some of the business she has seen indicates more work in the future, Ms. Williamson said, even though some state and local governments have begun to relax stay-at-home orders that kept nonessential businesses closed and consumers out of brick-and-mortar stores.

“Hotels are not going to bounce back quickly. You’re going to see a long-term effect on office space,” she told the Journal. “The consequence of the quarantine around the world…It’s not going to magically go away as you reopen.”

Bankruptcy lawyer James Conlan of Faegre Drinker Biddle & Reath said his group kept busy during May with work across a range of sectors, including energy, airlines, aircraft lessors, real estate, top automotive suppliers, hospitality and retail.

While many of those firms struggled because of the pandemic-related downturn, some had borrowed heavily leading up to the trouble, he said.

“I think we’re going to see an extraordinary number of large corporate bankruptcies, not just in the U.S. but across the globe,” Conlan said, and he is spot on: as we reported on Friday in its scramble to restore normalcy, the Fed forced companies to take on even more debt, much of which has been spent on dividends even as the newly indebted companies rushed to pursue mass layoffs. This means that merely another hiccup in the economy, another slowdown in revenues and cash flows will mean that an even greater array of companies will be facing bankruptcy.

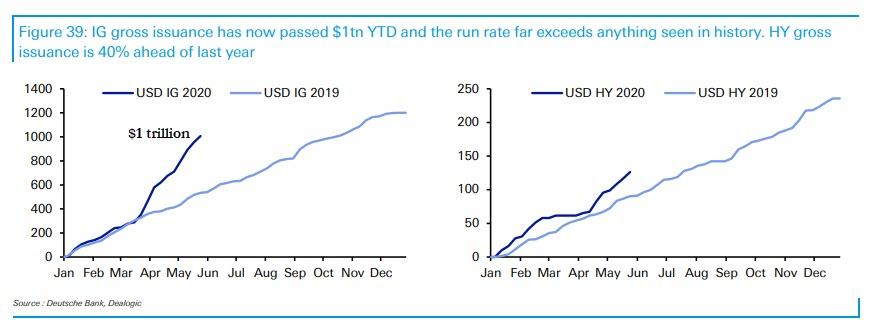

The wave of insolvencies is also at odds with U.S. credit markets, which are busier than ever: investment-grade corporations were able to cushion their balance sheets by borrowing over $1 trillion in the first five months of the year, the fastest pace on record…

… but there has been no such luck for weaker companies. Their revenues have evaporated, straining their ability to keep up with debt payments and all but forcing them to seek refuge in bankruptcy court.

And while there is little hope for a V-shaped recovery for the broader economy, no matter what Friday’s “erroneous” jobs report or the stock market suggest otherwise, one industry will be humming: bankruptcy lawyers and financial advisors. In fact, legal experts said they see no reason for the pace of corporate bankruptcies to slow in the coming months, especially as government relief programs taper off after July. The pace of filings will also be affected by the patience of lenders and landlords who might be willing to bend contracts and put off foreclosing, keeping firms out of bankruptcy.

“The Cares Act and other swift government measures have been successful in keeping consumers afloat during the crisis,” said Amy Quackenboss, executive director of the American Bankruptcy Institute, which represents more than 12,000 professionals, in a statement. “As this relief runs its course, however, mounting financial challenges may result in more households and companies seeking the shelter of bankruptcy.”

“I think we’re going to continue to see filings of at least the level we’re seeing for a while,” said Melanie Cyganowski, a former bankruptcy judge now with the Otterbourg law firm.

“If you know someone at the bankruptcy courts, be sure to thank them,” Duston McFaul, a partner at law firm Sidley Austin, told Bloomberg. “They’re already over-stretched and we’re only in the first inning.”

Source: ZeroHedge

Subscribe to Activist Post for truth, peace, and freedom news. Become an Activist Post Patron for as little as $1 per month at Patreon. Follow us on SoMee, HIVE, Flote, Minds, and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "“This Is Just The Start”: US Bankruptcies Soar 48% In May, Most Since Financial Crisis"