By Tyler Durden

By Tyler Durden

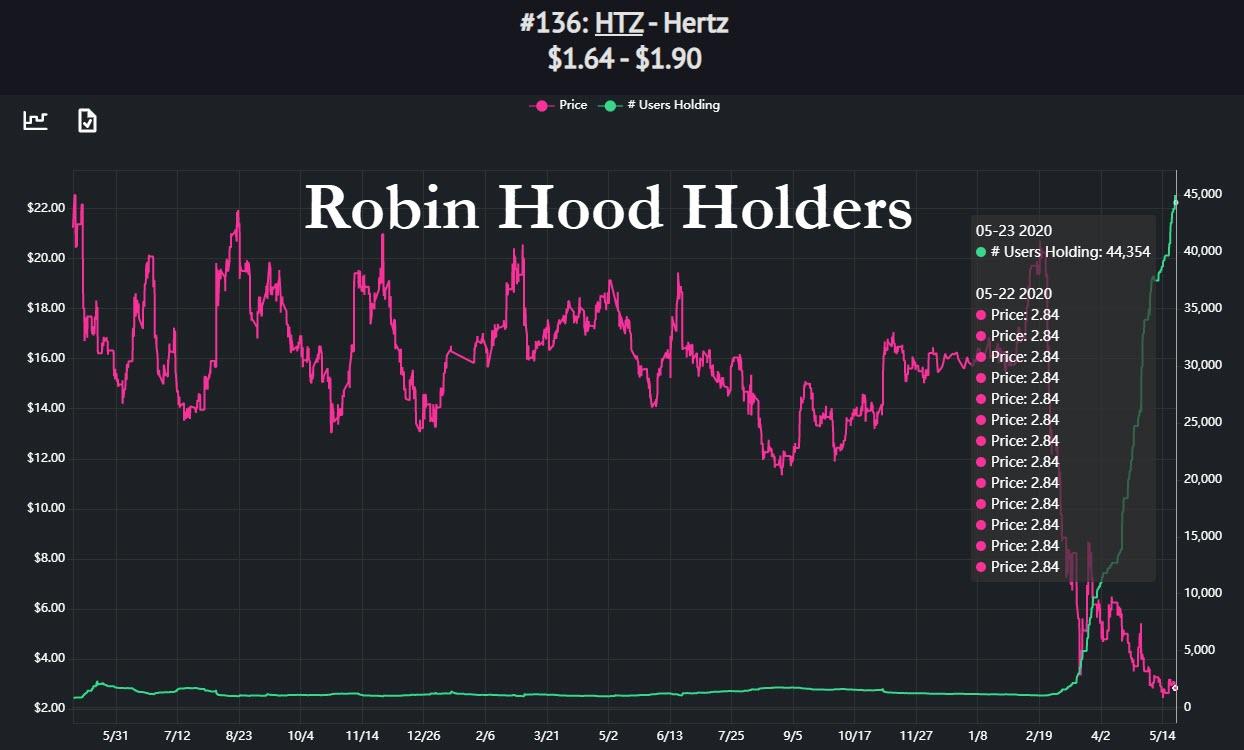

As if 44,354 Robin Hood traders suddenly cried out in terror and were suddenly silenced.

What one world war, one Great Depression and numerous oil price shocks couldn’t do, the coronavirus did in less than three months and late on Friday, auto rental giant Hertz, which was founded in 1918 when it set up shop with a dozen Ford Model Ts, quietly filed for Chapter 11 bankruptcy protection struggling under a massive debt load after its business was brought to a grinding halt during the coronavirus pandemic and talks with creditors failed to result in much needed relief.

The company had a total of 568,000 vehicles and 12,400 corporate and franchise locations worldwide at the start of this year. About a third of those locations are at airports.

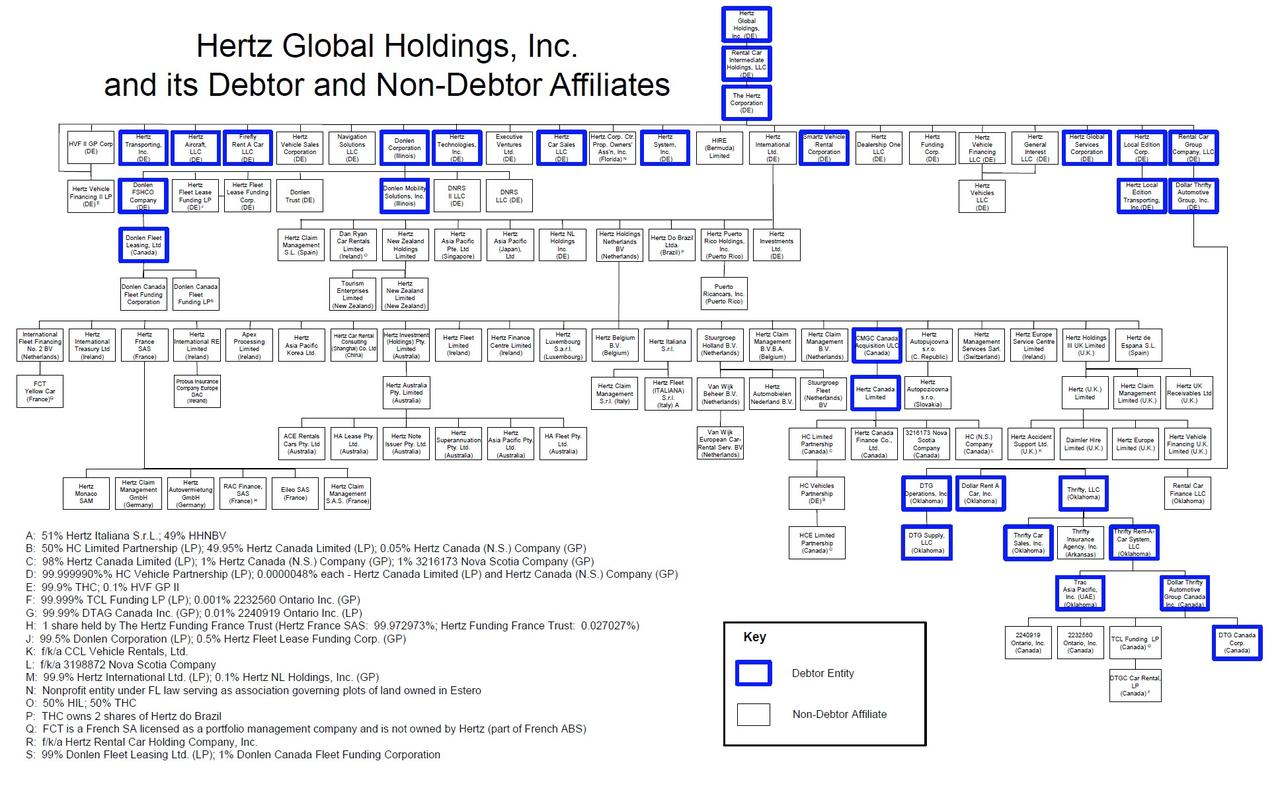

By declaring bankruptcy, Hertz said it intends to stay in business while restructuring its debts and emerging a financially healthier company. The board of Hertz, whose org chart listed dozens of debtor and non-debtor affiliates…

… earlier on Friday approved the company’s Chapter 11 filing in a U.S. bankruptcy court in Delaware, according to court records, news of which was promptly leaked and sent the stock – which had in recent days become a darling for retail daytraders on Robinhood and elsewhere who expected a swift rebound in the price and BTFD – crashing . Its international operating regions including Europe, Australia and New Zealand were not included in the U.S. proceedings.

“The impact of COVID-19 on travel demand was sudden and dramatic, causing an abrupt decline in the company’s revenue and future bookings,” said the company’s statement adding that while it took immediate action in response to the crisis, “uncertainty remains as to when revenue will return and when the used-car market will fully re-open for sales, which necessitated today’s action.”

See: 177 Different Ways to Generate Extra Income

“With the severity of the Covid-19 impact on our business, and the uncertainty of when travel and the economy will rebound, we need to take further steps to weather a potentially prolonged recovery,” Hertz’ new CEO Paul Stone said in a statement.

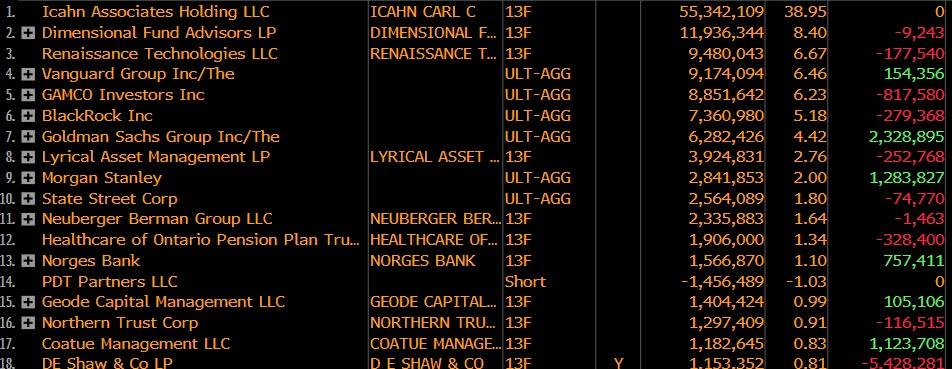

The firm, which already was suffering from a decline in demand as a result of the ubiquity of cheaper car-hailing services, and whose largest shareholder is billionaire investor Carl Icahn with a nearly 39% ownership stake…

… was left reeling after government orders restricted travel and ordered citizens to remain home. A large portion of Hertz’s revenue comes from car rentals at airports, which have all but evaporated as potential customers eschew plane travel.

Then there is the debt: with nearly $19 billion of debt and roughly 38,000 employees worldwide as of the end of 2019, Hertz was among the largest companies to be undone by the pandemic.

Hertz had $18.8 billion of debt on its books as of March 31, up $1.7 billion from the end of last year. Most of that debt, $14.4 billion, is backed by its vehicles. That includes the debt for which it missed the payment in April the prompted this latest crisis.

Hertz’s woes are compounded by the complexity of its balance sheet, which includes more than $14 billion of securitized debt. The proceeds from those securities finance purchases of vehicles that are then leased to Hertz in exchange for monthly payments that have risen as the value of cars fall. Hertz also has traditional credit lines, loans and bonds with conditions that can trigger defaults based on missing those lease payments or failing to meet other conditions, such as delivering a timely operating budget and reimbursing funds it has borrowed.

The public health crisis has also caused a cascade of bankruptcies or Chapter 11 preparations among companies dependent on consumer demand, including retailers, restaurants and oil and gas firms. And while US airlines had so far avoided a similar fate after receiving billions of dollars in government aid, Hertz was unable to get a government handout and this is the result.

The Estero, Florida-based company, which operates Hertz, Dollar and Thrifty car-rentals, had been in talks with creditors after skipping significant car-lease payments due in April. Forbearance and waiver agreements on the missed payments were set to expire on May 22. Hertz has about $1 billion of cash, which is why it won’t need a debtor in possession loan. The company said it might need to raise more, perhaps through added borrowings while the bankruptcy process moves forward.

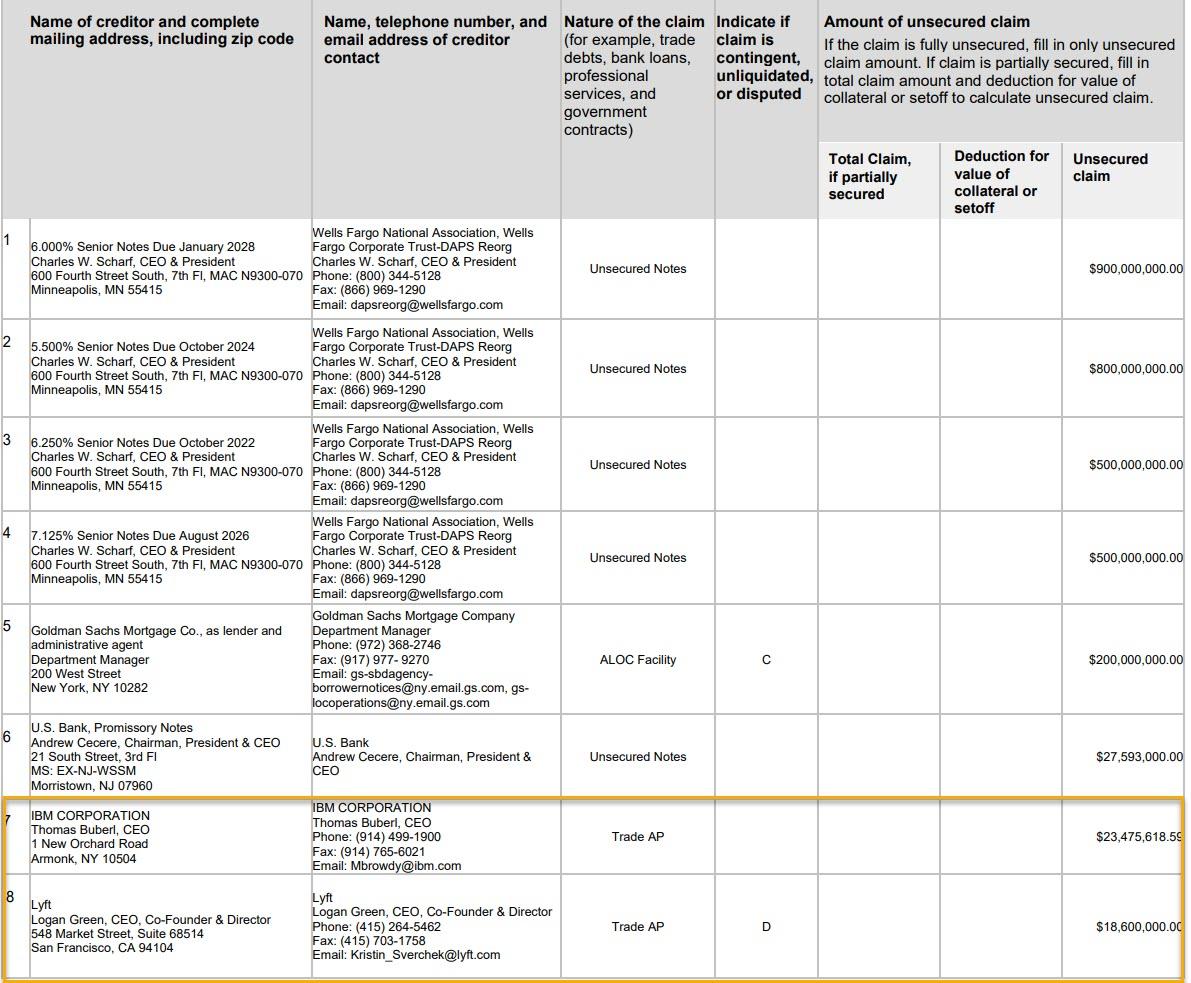

The company listed total assets of $25.8 billion and total debt of $24.4 billion on its bankruptcy petition, estimating more than 100,000 total creditors, of which IBM and Lyft were listed as the biggest.

The size of Hertz’s lease obligations have increased as the value of vehicles declined because of the pandemic. In an attempt to appease creditors holding asset-backed securities that finance its fleet of more than 500,000 vehicles, Hertz proposed selling more than 30,000 cars a month through the end of the year in an effort to raise around $5 billion, a person familiar with the matter said; that effort was seen as insufficient.

Just four days before the filing, the Hertz board appointed executive Paul Stone to replace Kathryn Marinello as CEO. Earlier notified 12,000 employees in North America that that they were losing their jobs, and another 4,000 are on furloughs. Its US workforce stood at 38,000 employees at the start of the year, with about a quarter of them represented by unions.

After the coronavirus pandemic decimated revenue, the car renter sought relief from lenders and a bailout from the U.S. Treasury Department. But while it managed to negotiate a short-term reprieve from creditors, it wasn’t able to work out longer-term agreements. A trade group representing Hertz, the American Car Rental Association, has asked Congress to do more for the industry by expanding coronavirus relief efforts and advancing new legislation targeting tourism-related businesses.

Even before the pandemic, Hertz and its peers were under financial pressure as travelers shifted to ride-hailing services such as Uber. To combat Uber, Hertz had adopted a turnaround plan, aiming to modernize its smartphone apps and improve management of its fleet of rental cars.

The filing has been the highest-profile bankruptcy of the COVID-19 crisis so far, which has prompted bankruptcies by national retailers like JCPenney, Neiman Marcus and J.Crew, along with some energy companies such as Whiting Petroleum and Diamond Offshore Drilling. But none of the companies to file so far have had such as large a share of their industry as does Hertz, which along with rivals Avis Budget and privately held Enterprise dominate the rental car industry.

The entire rental car industry has been devastated by the plunge in travel since the pandemic hit earlier this year.

Nearly two-thirds of its revenue comes from rentals at airport locations, and air travel has fallen sharply. Since the start of April, the number of people passing through TSA checkpoints at US airports has plummeted 94% compared with a year ago.

A significant portion of Hertz’s nonairport business is renting cars to people who are having their vehicles repaired after accidents. But with so many people out of work or working from home, the miles being driven and the number of car accidents are down significantly. Car insurers are voluntarily returning more than $7 billion, or between 15% to 25% of premiums, to their customers.

Hertz was founded in Chicago just more than a century ago by Walter Jacobs, who sold the company in 1923 to John Hertz, who renamed it and expanded the fleet to 600 cars. He began the nation’s first national rental network in 1925 and opened its first airport location at Chicago Midway Airport in 1932.

Hertz has had a number of high-profile corporate owners, including RCA, United Airlines, and most recently Ford, which sold it to a group of private equity firms in 2005 for $5.6 billion. It was taken public a year later.

Its primary shareholder today is activist investor Carl Icahn, who owns about 38% of its shares outstanding. He continued to increase his stake in the company all the way through mid-March. Those shares, which increased the size of his stake by 26%, have lost more than 60% of their value in the two months since his most recent purchases.

The company’s legal and financial advisors are White & Case and FTI Consulting , while Moelis is its investment banker. The case in 20-11218 in the District of Delaware.

The full first-day bankruptcy motion can be found here.

Source: ZeroHedge

Image: Pixabay

Subscribe to Activist Post for truth, peace, and freedom news. Become an Activist Post Patron for as little as $1 per month at Patreon. Follow us on SoMee, HIVE, Flote, Minds, and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Hertz Files For Bankruptcy As Lockdowns Crush Rental Car Industry"