By Tyler Durden

By Tyler Durden

Seeing as most young Americans are saddled with student-loan debt, underemployment and other economic blights, few have any money left for important large purchases like a home. At this point, it’s beginning to look like millennials will be remembered as the first renter generation in the country’s history.

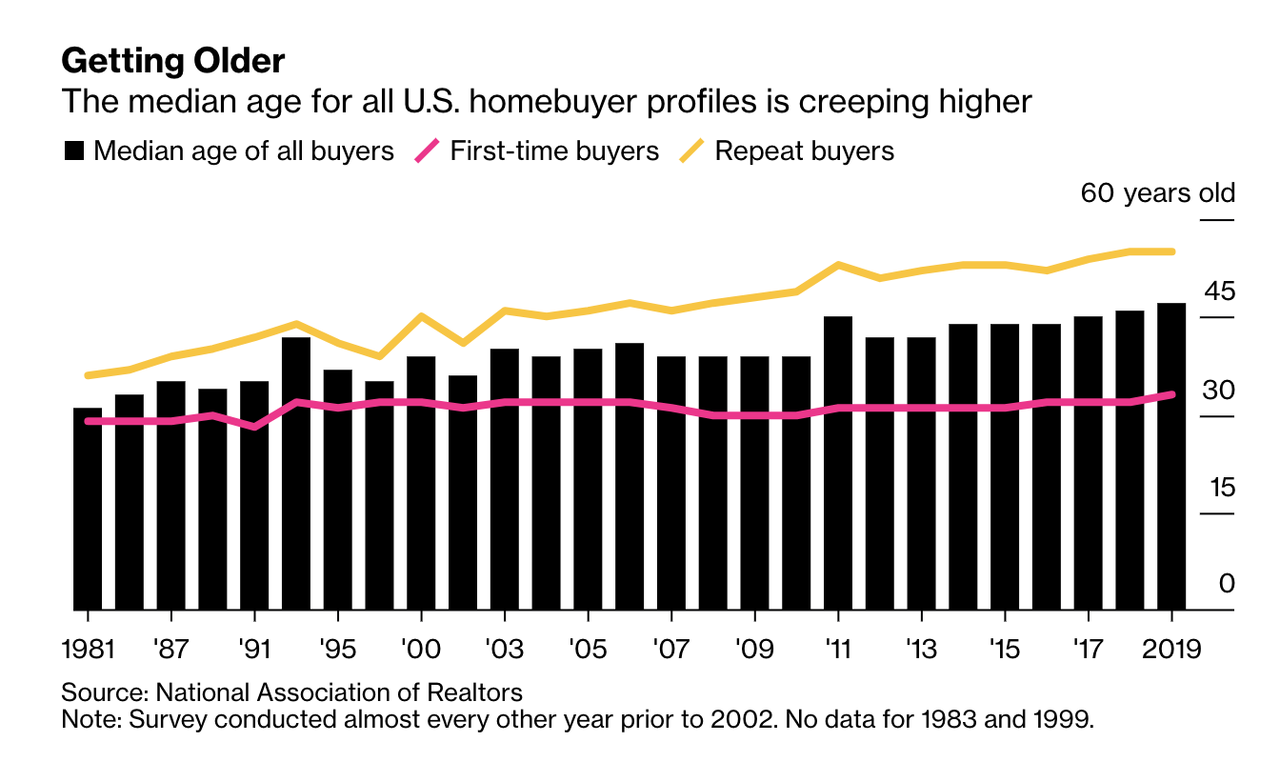

To wit, according to data from the National Association of Realtors, the median age of first-time home buyers has increased to 33 in 2019, the highest median age since they started collecting the data back in 1981. Meanwhile, the median age for all buyers hit a fresh record high of 47, climbing for the third straight year, and well above the median age of 31 in 1981.

Source: Bloomberg

Though the median age for first timers only increased by one year, BBG reports that it reflects a variety of factors impacting those who are searching for a home.

For one, since the housing-market collapse ten years ago, construction of affordable housing has never recovered. Low housing stock, coupled with low interest rates, has stoked higher prices, especially in more affordable markets from the coasts to the middle of the country. This made circumstances ideal for older Americans with more assets to borrow against and cash on hand. But younger Americans who don’t have enough saved for a down payment lost out.

See: 177 Different Ways to Generate Extra Income

“Housing affordability is so difficult today, especially when coupled with rising rents and student loan debt, that they’re finding different ways to enter home ownership,” said Jessica Lautz, vice president of demographics and behavioral insights at the Realtors group in Washington.

That’s not all: the percentage of first-time buyers who are married has declined as more single people buy homes to share with girlfriends, boyfriends or roommates. As the average ages of home buyers increases, average incomes have also risen. The median income of purchasers rose to $93,200 in 2018 as the disappearance of affordable housing pushes low-income buyers out of the market.

Factoring in the expansion of economic inequality, young buyers who do manage to buy their own homes typically receive a small gift from their relatives to help cover the down payment first.

This article was sourced from ZeroHedge.com

Image credit: Pixabay

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Flote, Minds, Twitter, and Steemit. Become an Activist Post Patron for as little as $1 per month at Patreon.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Young First-Time Buyers Are Vanishing From US Housing Market"