By Tyler Durden

By Tyler Durden

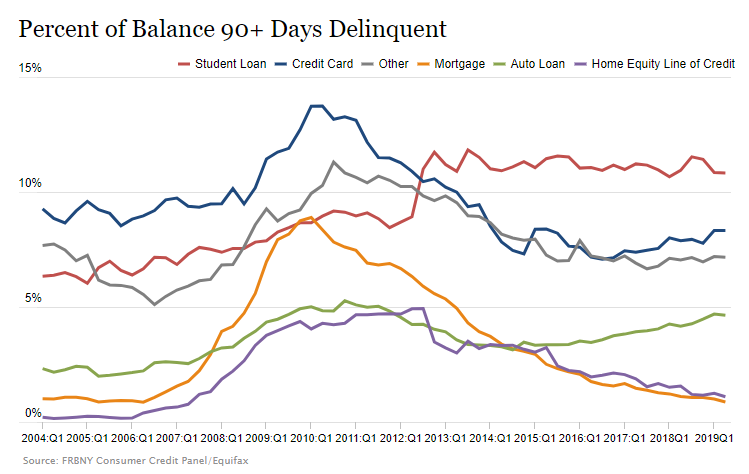

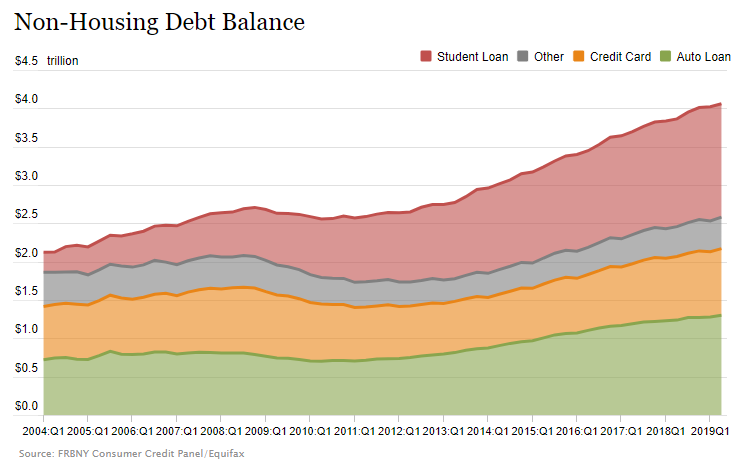

Millions of Americans are finding it virtually impossible to keep up with their car payments, despite supposed “economic growth” and low unemployment, according to Reuters. In fact, more than 7 million Americans are already late by 90 days or more on their car loans, according to data from the New York Federal Reserve, as delinquency rates among borrowers with low credit scores have seen the fastest acceleration.

Part of the issue stems from the economic downturn a decade ago where automakers slashed production. This has made a rarity of 10-year-old used vehicles, which are typically the cars sought out by low-wage earners.

This lack of supply and rising demand has caused prices to spike, with the average price of a 10-year-old used vehicle coming in at $8,657, nearly 75% higher than 2010, which is “pushing poor Americans over the edge” according to Reuters. Over the same time, the average increase in new car prices is only 25%.

Ivan Drury, Edmunds’ senior manager of industry analysis, said that “this is pinching people at the worst point possible. If you need basic A to B transportation, you have to get an older car that needs more repairs and has more wear-and-tear issues.”

Monthly auto payments for Americans who make under $40,000 per year have remained flat since 2017. Those in higher wage brackets have seen payments rise. But rather than this being good news, it indicates that poor Americans are stretched so much that they literally can’t afford to pay more. As Cox chief economist Jonathan Smoke pointed out, “they just don’t have any flexibility to increase their payment.”

And the rising delinquency rates are being blamed on weaker lending standards in recent years.

See: 177 Different Ways to Generate Extra Income

Warren Kornfeld, a senior vice president on Moody’s financial institutions team, said: “Auto lenders are belatedly tightening lending standards, but it may already be too late. The economy is masking the true performance of auto loans. If we hit a downturn today, the performance of auto loans would not look very good.”

New York Fed data shows that delinquencies among subprime borrowers have been rising and have been the catalyst pushing up the overall delinquency rate. About 8% of loans originated by buyers with a credit score under 620 are categorized as seriously late. Fed researchers called this data “a development that is surprising during a strong economy and labor market.”

Gordy Tormohlen of Good People Automotive says that business is up 10% this year as auto finance companies have been tightening lending standards. Ominously, he said “the market feels like it did before the financial crisis hit in 2008, when consumers were over-extended with debt.”

Customers of his include people like Hollis Heyward, who recently had to rework his loan and is now only paying $120 per month to pay off his principal owed, down from about $350 a month. And it doesn’t look like there will be good news anytime soon: analysts are predicting that it could take years for older used cars to return to more affordable levels.

Ken Shilson, president of the National Alliance of Buy Here, Pay Here Dealers (NABD), said:

American consumers have become too comfortable with debt and subprime customers have been “poisoned” by easy access to capital for much of the long economic expansion. But he added those customers will be forced by tighter underwriting to seek even older vehicles.

“The American way is to always live beyond your means and Americans aren’t good at making life adjustments,’ Shilson said. “But there’s a reality check coming and many subprime buyers will be forced to find more affordable transportation.”

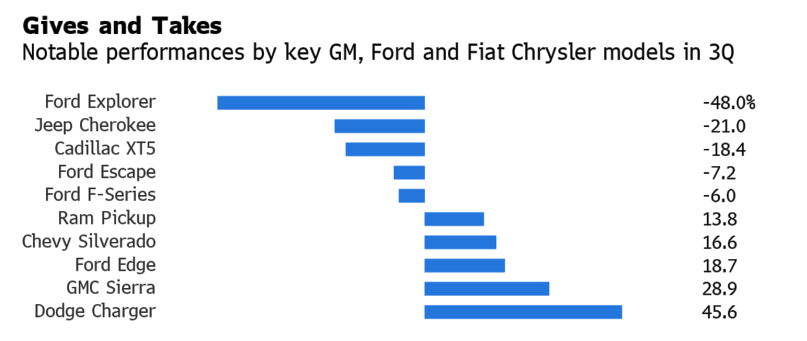

Just days ago, Bloomberg reported that “sticker shock” was the cause for growing stress in the automotive industry.

Auto dealer Robert Loehr said of new car prices: “Prices are crazy on cars nowadays — all of them. They’re crazy to me, and I do it every single day, all day long,”

Brian Irwin, who leads the automotive and industrial practice for consulting firm Accenture, says the auto industry has reached the end of its run, stating: “It’s a step down from where we thought we would be a few months ago. I expect to see stronger incentives coming out.”

This article was sourced from ZeroHedge.com

Top image credit: Pixabay

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Minds, Twitter, Steemit, and SoMee. Become an Activist Post Patron for as little as $1 per month.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Soaring Used Car Prices “Push Americans Over The Edge” As Subprime Delinquencies Surge"