In my last article, “The Bears Have it Right: Economy went Polar Opposite of Bullish Predictions,” I laid out my first prediction for 2019 — a recession by summer. I don’t want the following revelations and facts that I have since come across to get lost in comments I recently posted to that article, so I’m bringing them all together here.

How bad was 2018?

The Wall Street Journal just said it was “one of Buffett’s worst years ever.”

For the full year, Berkshire Hathaway’s earnings were down 90% from $45 billion the previous year. Their biggest hit came from a $25 billion loss in the fourth quarter. Interesting that the fourth quarter hit the world’s most famous investor that hard because that is the very quarter I said would be the worst of all in the stock-market crash of 2018 (which I believe is ongoing by the way; more on that next).

For anyone who still thinks the stock market’s plunge at the end of 2018 was not already a significant market crash, regardless of what follows, I present you this evidence: The Wall Street Journal says that for the world’s greatest investor, it resulted in his worst year EVER! (And he’s a very old man.)

Next, consider that Buffet’s worst year was also one of the biggest years for massive corporate tax breaks, which fueled an epic boost to earnings (calculated after taxes) and to stock buybacks (which even Buffet engaged in), and consider that Warren Buffet is widely regarded as the shrewdest safest-betting billionaire on the planet, known for never having a bad year even if he does from time to time have a few bad investments.

And then consider that Buffet is also refusing to invest in the present market, even in spite of the present rally. Maybe even because of it. He is sitting on a massive cash pile of more than $100 billion, mostly in treasury bills, which he says he cannot wait to spend; and, yet, he is waiting for an opportunity to invest because he believes this market is overpriced and still has more falling ahead.

Buffet says in his annual letter to investors:

In the years ahead, we hope to move much of our excess liquidity into businesses that Berkshire will permanently own. The immediate prospects for that, however, are not good: Prices are sky-high for businesses possessing decent long-term prospects.

Sky-high.

Where are we now?

Speaking of that rally, let us briefly survey the market’s present perch via a couple of graphs put out by Sven Henrich, starting first with a quote from his recent article:

For bulls the danger here remains that this rally was an extremely aggressive counter rally in context of a broken bull market trend. For a reversal in the near future could quickly change the perspective of this rally:

Why? Because a reversal in the near term could confirm that the bull market trend is indeed broken, in which case the technical picture suggests that the December correction was just the first step. Remember, technically speaking, a break of the bull market trend in earnest suggests a much larger long term fib retrace risk:

That’s the recession scenario everyone seems to be keen on denying being a possibility.

While I have never made a market prediction or economic prediction based on charts, I have had to point out more than once to my bird-brained crow that hangs around here, that I do find it interesting when charts everywhere I look are starting to back up what I’ve already been saying.

So, I am not using this chart as a basis for prediction but to show the precarious perch we have attained and that nothing about this rally so far is outside of being the kind of huge bear-market rally I have repeatedly said we can expect.

Where are we going?

Looking to fundamentals, which is how I make my predictions, things are looking worse and worse for stocks going forward, not better:

According to Factset, the average Wall Street forecast now projects Q1 earnings per share to decline by 2.7% Y/Y, worse than a consensus -0.8% forecast drop three weeks ago, and starkly lower than the +3% EPS growth expected for Q1 at the start of the year…. In a troubling twist, this EPS is taking place even as companies continue to buyback record amounts of stock…. Morgan Stanley’s Mike Wilson … wrote that “we are increasingly convinced that consensus earnings expectations for 2019 have further to fall and that the optimistic uptick currently baked into 4Q19 estimates is unlikely to happen.”

That is a 5.7% reversal from what was expected at the start of this year in spite of the fact that the market has been rallying throughout that trend reversal. (On a fundamental basis, that doesn’t make this rally smart at all. Instead, it makes it look exactly like the inebriated optimism that always steers bulls into huge traps in bear markets.)

Morgan Stanley’s Michael Wilson noted that “Earnings Revisions Have Been Some Of The Worst We’ve Ever Observed…. Wilson today writes that his earnings recession call is playing out even faster than he expected, adding that “when we made our call for a greater than 50% chance of an earnings recession this year, we thought it might take a bit longer for the evidence to build.” In retrospect it took just over a month for forward guidance to collapse.”

Zero Hedge

Whether the Fibonacci lines shown in the last graph are fibbing or not may soon be tested based on this other graph from Bloomberg that shows our present precarious perch from another perspective:

That is just the current set-up. Are we going to bounce along on that relatively hard ceiling, punch our head through it and stay above it, or knock ourselves out trying only to fall back into the pit of a greater recession? The graph has no capacity to predict where we will go, but only shows that we are perched on a ledge that is exactly in keeping with the three previous failed rally attempts. So, there is no basis for assuming, because it is a big rally, we are now in the clear. With our current position clarified, I want to now turn to a recession indicator that has never never been wrong: (Again, its not the basis for my prediction, which was made ahead of seeing this, but it shows that the best tools of the chart-watching investment firms are lining up with what I’ve already predicted.)

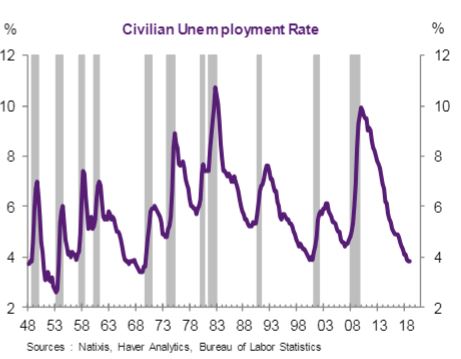

“A recession indicator with a perfect track record over 70 years is close to being triggered

“It’s never been wrong. It’s something to watch,” said Joseph LaVorgna, , chief economist for the Americas at Natixis. According to Lavorgna, since 1948, the economy has always entered or been in a recession when the unemployment rate increased 50 basis points (or 0.50 percentage point) from its trailing cyclical low. He said a recession occurred in the 11 instances regardless of the level of unemployment.

That looks like this now that the unemployment rate has just started turning back up from a long trailing low, which is right where all previous recessions began:

LaVorgna, however, expects the unemployment rate to turn south again right away before hitting that critical 50 basis-point rise he mentions. (Right now we are at a 30 basis-point uptick.) If he’s right, we’ll narrowly miss triggering the one recession indicator that “has never been wrong” for a little longer. Of course, I didn’t place the start of the next recession in my last article’s prediction until summer, so I think Lavorgna could be right, too … until then.

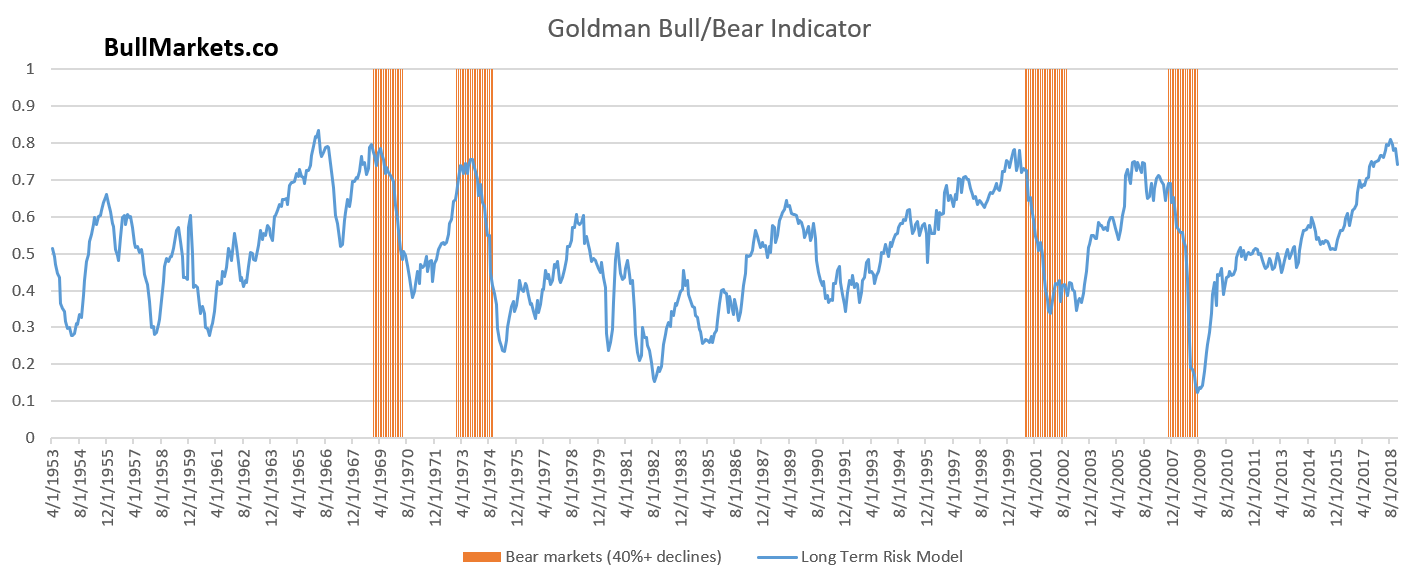

Goldman Sachs has its own indicator of major bear markets that it believes is rarely wrong. Here it is:

The orange boxes above mark major bear markets (as opposed to recessions, though in both of the last two cases major recessions would have overlapped). Notice where we sit right now compared to the last two times when Goldman’s bull-bear indicator sat this high and then fell off a little for just about as long as it has fallen off now.

Which is to say, don’t let the present rally fool you. There is nothing here that is not in keeping with the worst bear markets in corporate history. Decide for yourself if this is a ledge you feel comfortable sitting on. The past doesn’t predict the future, but it certainly tells us what can happen in situations that look exactly like the present.

Of course, the Fed is reversing course now, so we’ll be safe, right? I’ve routinely pointed out for a number of years that the Fed has a perfect history of tightening into every recession; and my predictions for 2018 always said I believed the Fed would not change course until it is too late, and yet it has already begun. So, maybe the Fed is ahead of the curve this time, or maybe we’re already staring into the abyss of a recession and just don’t know it. Maybe the first quarter of 2019, wherein GDP estimates are being sharply revised down week after week, may turn out negative.

Regardless, the Fed has not completely stopped tightening; it has just talked of doing so. Based on how long it sounds like it will be before they actually stop their Great Recovery Rewind and the lag time I’ve mentioned more than once between Fed actions and economic impact, I think summer is about right. However, if you won’t take my word about the imminence of a recession, let me give a billionaire the final word:

Having hiked rates from 0.00% … to … 2.50%, the Fed abruptly stopped. A $1.5trln tax stimulus, expanded budget deficits, and deregulation provided the cover for the US central bank to attempt to normalize policy. No other major nation has been able to come close. And now they’ve all turned dovish, bumping along the bottom, with rates still at crisis settings.

Economies operate with a lag, and the tightening that has already occurred virtually assures a more dramatic slowdown, or recession later this year or 2020…. Even if the Fed ends its balance sheet reduction later this year, that tightening will also take time to work its way through the system.

(Thank you to all the readers here who have put me past my minimal goal for continuing this site! That minimum guaranteed I’d give this site time to develop until, at least, summer to see if it can keep building readership and support now that the economy has started to turn to where people may start to listen more to opinions that don’t match up with the establishment view. Originally, I was only going to give until the end of December to make the minimal target, which I set as a way of gauging whether there was enough interest to try longer. I didn’t really think we would come close to hitting it because people are used to getting everything off the internet for free; but I figured I should, at least, try before calling it quits. Readers, however, came through more supportive than I thought would happen, so I stayed with it a little longer, and so did you. Even if we don’t ever hit my secondary dream goal, I imagine I will continue writing as long as interest and support is moving in a positive direction and as long as the economy remains interesting. Now that we’ve met that original goal, getting the promised member forum up and running is something I need to do. I still hope to find some volunteer tech support, as things like setting up a forum take up my limited time for writing. My next article will be one of my Premium Posts on the coming credit crisis. If you want to read that more extensive analysis, you may want to sign up at the $5/month level before it’s published if you haven’t already.)

Liked it? Take a second to support David Haggith on Patreon!

Be the first to comment on "More Evidence that the Bears Have it Dead Right"