Jake Bernstein and Jesse Eisinger

Jake Bernstein and Jesse Eisinger

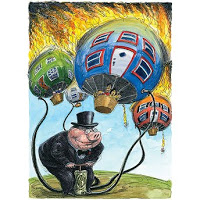

Over the last two years of the housing bubble, Wall Street bankers perpetrated one of the greatest episodes of self-dealing in financial history.

Faced with increasing difficulty in selling the mortgage-backed securities that had been among their most lucrative products, the banks hit on a solution that preserved their quarterly earnings and huge bonuses: They created fake demand.

A ProPublica analysis shows for the first time the extent to which banks — primarily Merrill Lynch, but also Citigroup, UBS and others — bought their own products and cranked up an assembly line that otherwise should have flagged.

The products they were buying and selling were at the heart of the 2008 meltdown — collections of mortgage bonds known as collateralized debt obligations, or CDOs.

Be the first to comment on "Banks’ Self-Dealing Super-Charged Financial Crisis"