By John Phelan

Fifty years ago, the Minneapolis Tribune reported a silver lining in an otherwise gloomy economic climate.

“Christmas tree prices aren’t expected to rise this season,” the newspaper reported in November 1974, “a small solace for many struggling Minnesota families.”

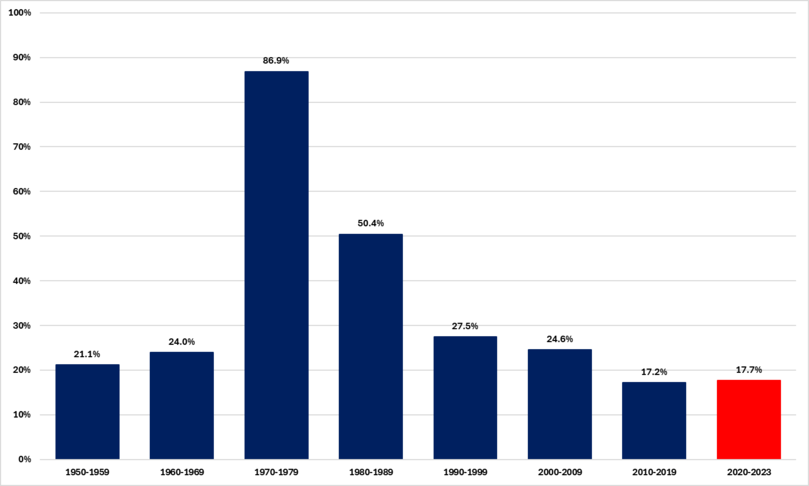

That month, the annual rate of inflation hit a peak of 12.2 percent. It would fall to 5.0 percent in December 1976 before peaking again at 14.6 percent in March 1980. Between 1970 and 1979, the Consumer Price Index (CPI) rose by 86.9 percent compared to 24.0 percent from 1960 to 1969.

Increase in Consumer Price Index

Increase in Consumer Price IndeSource: Federal Reserve Bank of St. Louis

Inflation would have dominated Richard Nixon’s America if it hadn’t been dominated by Vietnam and Watergate instead. It did dominate the America of his short-lived successors, Gerald Ford and Jimmy Carter. In 1980, as “How to Beat the High Cost of Living” hit cinemas, journalist Theodore H. White wrote that conversation was “stained and drenched in money talk, by what it cost to live or what it cost to enjoy life” and recalled restaurant meals “with the host sneaking a glance at the tab and stunned, surreptitiously adding up the figures to verify the total.”

“Everybody’s desperate tryin’ to make ends meet,” Warren Zevon sang, “Work all day they still can’t pay the price of gasoline and meat…Even Jimmy Carter,” he concluded, “has got the highway blues.”

Winners and Losers: Taxes and commodities

Inflation produced winners and losers.

As nominal property values surged, so did property tax payments, hitting those on fixed incomes hardest. “There is no way I can come up with the expected taxes,” one woman wrote to California’s Governor Jerry Brown. “I had hoped that by age 65, the house would be paid for, and I would have a place to live. But I now see that all the planning is in vain because our government will not allow this to happen.”

This phenomenon, “bracket creep,” where inflation pushed taxpayers into higher brackets, increasing their tax burden without a real increase in income, hit income taxpayers too.

But there were winners: government. As historian Bruce J. Schulman notes, “…inflation swelled the coffers of state and local governments even as it squeezed taxpayers. California and many other states ran huge budget surpluses in the 1970s.”

“I’m tired of paying for politicians’ dinners and lunches when my family can’t afford to go out to dinner even once a month,” another letter to Brown read. “I’m tired of doing without so that you all can have everything.”

There were other winners as the dollar lost value and the nominal price of successive commodities “popped,” with oil in 1973 only the last to do so. These were high times for commodities producers. Dollar prices of corn, soybeans, and wheat approached or exceeded record levels. A bushel of wheat, for example, more than tripled in price between the summers of 1972 and 1973. The prices of “real” assets like land also surged.

By 1974, farmland in Murray County, Minnesota, was fetching four times more than it had in 1970. “There was a good economy,” one resident recalled, “Land prices went up. Commodity prices were good. People were investing money. Equipment dealers were doing really well, and the car dealers were doing really well. It was one of the best times there ever was in Murray County.”

Disinflation soon turned these winners into losers. Even with the worst drought since the 1930s, prices fell. Wheat prices tumbled from $5.85 a bushel in 1974 to $1.92 in 1977, and corn prices fell by 50 percent. Crop losses in Murray County totaled $25 million.

Attitudes: Saving and borrowing

Savers were losers, and borrowers were winners, so inflation altered attitudes to saving and borrowing. Schulman writes that:

“Depression babies – people who grew up during the 1930s – possessed a certain approach to life, a certain suspicion about good times, a thriftiness, a tendency to reuse tea bags and never throw anything away. The Great Inflation produced its own generation, altering Americans’ relationship to money, government, and each other.”

“‘Never buy what you can’t afford’ was the admonition of our parents,” economist Christopher Rupkey wrote in the New York Times. “Today, the statement has been changed to, ‘You can’t afford not to buy it.” More young couples:

“…live in the same comfortable homes and sit in the same sumptuous sofas that are equal or better than those of their parents, many of whom worked for years to obtain what their children get with a simple flash of a credit card…Get your money out of the bank and spend it!”

Several innovations, from credit cards to Money Market Mutual Funds, facilitated this, and consumer borrowing rose from $167 billion in 1975 to $315 billion in 1979. Rupkey concluded that “Inflation gives the most it has to give to those with the largest piles of debts.”

A Crisis of Government

Inflation made the government look helpless. Economist Alfred Kahn, appointed by Carter as special advisor on inflation, believed that it:

“…was not just an economic problem but a profoundly social problem – a sign of society in some degree in dissolution, in which individuals and groups seek their self-interest and demand money compensation and government programs that simply add up to more than the economy is capable of supplying.”

This was attractive politically; it shifted the blame. “I do not have all the answers. Nobody does,” Carter said in 1978, “Perhaps there is no complete and adequate answer.” But, alongside the seizure of American hostages in Iran in November 1979 and subsequent bungled rescue attempt and renewed Soviet aggression, seen in the invasion of Afghanistan the following month, this made Carter’s administration seem weak. The New York Times wrote that the American Dream had been replaced by the:

“…dismay and confusion that accumulate when inflation and recession change the value of money and all that money means, culturally and psychologically; when the assumptions of several generations about America’s expertise and leadership and this country’s pre-eminent place in the world are jumbled and wounded; when values are distorted and called into question by economic conditions that affect, in different ways, every class in society.”

It was bogus economically, as Milton Friedman argued, and Paul Volcker demonstrated in bringing inflation down to 1.6 percent in 1986.

But socially, it contained more truth. In 1919, the economist John Maynard Keynes wrote:

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method, they not only confiscate, but they confiscate arbitrarily, and while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.

Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires become “profiteers,” who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless, and the process of wealth-getting degenerates into a gamble and a lottery.”

The American inflation of the 1970s illustrates this perfectly.

Whether we have learned anything since or are doomed to repeat and relive the “utter disorder” of a fluctuating value is what remains to be seen.

Originally Published on AIER’s The Daily Economy.

Sourced from Money Metals Exchange

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Telegram, HIVE, Minds, MeWe, Twitter – X and Gab.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Are We Doomed To Relive Nixon-Era Inflation?"