Authored by Nick Corbishley via NakedCapitalism.com,

Authored by Nick Corbishley via NakedCapitalism.com,

In a major U-turn in the Global War on Cash, the government and central bank of Norway, one of Europe’s most cashless economies, are seeking to slow or even reverse the mass abandonment of cash. Only 3% of Norwegians used cash in their latest purchase in a physical shop, according to a recent central bank survey.

In a bid to change that, a new amendment to Norway’s Financial Contracts Act came into force on October 1 that bolsters citizens’ rights to pay with cash in retail settings. The new legislation should sound the death knell for all the “we only accept cards” signs plastered on shop windows throughout the country, reports the Norwegian online newspaper Nettavisen.

Norway’s central bank, Norges Bank, explains on its website how the new amendment will “clarify” customers’ right to pay in cash:

Section 3-5 (1) of the Central Bank Act stipulates that banknotes and coins issued by Norges Bank are legal tender. It further states that no one is obliged to accept more than 25 coins of each denomination in one transaction. Beyond this, the Act does not elaborate on what legal tender implies.

In June 2024, the Storting enacted an amendment to Section 2-1, third paragraph of the Financial Contracts Act, clarifying consumers’ right to pay with cash:

“In sales premises where a business regularly sells goods or services to consumers, the consumer shall be offered the option to pay with legal tender if it is possible to pay for the goods or services with other payment solutions in or in immediate connection to the sales premises. If the business has available change, it must also offer to provide change in connection with the payment, unless there is a clear discrepancy between the banknote offered as payment and the amount to be paid. The first and second sentences do not apply to the sale of goods from vending machines, sales in unstaffed premises, and sales in premises to which only a limited group of people have access. The first and second sentences also do not apply when the amount to be paid exceeds 20,000 kroner.”[1]

For anyone wondering, 20,000 kroner is worth close to $2,000. As Norge Bank explains, retail businesses that refuse to abide by this change in the law could face financial penalties:

In connection with this legislative amendment, the Storting also decided to introduce a sanction in the form of an administrative fine, which may be imposed if businesses willfully or negligently violate the rules in Section 2-1, third paragraph.

Motive #1: Genuine Financial Inclusion

One of the main justifications for the legislation is to support the estimated 600,000 people in the country — equivalent to roughly 10% of the population — who struggle to use digital payments, and who have been increasingly excluded from the retail economy. Cashless economics is often touted as a means of encouraging financial inclusion, which generally means extending exploitative and abusive financial services to those previously excluded. However, in reality there is no more inclusive form of payment method than cash.

“In a digital world, it can be easy to forget that there is a large group of people who are not digital,” says Minister of Justice and Public Security Emilie Enger Mehl. “Cash is also an important emergency preparedness for society. I am pleased that the majority in the Storting [Norway’s parliament] so clearly supported our proposal to strengthen the right to pay with cash. The regulations have been too unclear. People should be confident that they will be able to pay when they go to the store, to a restaurant or to the hairdresser.”

Many Norwegian pensioners are “jubilant” about the change in law, reports Nettavisen.

“This is very important for all the elderly who struggle to pay online, remember the code or who struggle to trust bank cards,” says manager Jan Davidsen, manager of the Norwegian Pensioners’ Association. “For many, cash provides security, it is something they have become accustomed to over the course of a long life. This has been a battle for us, so now we are going to celebrate!”

But not everyone is cracking out the champagne. As NC reader Anders points out in the comments below, Norway, like neighbouring Sweden, has near-free debit cards. And although the payment terminal does have fees associated with it, the costs for retailers are less than what cash costs. Some retailers are far from enamoured with the idea of having to once again handle cash.

“I’m not going to change my practices,” Anders Ellburg, general manager of Holmenkollen, an upmarket restaurant in Helsinki, tells Finans Fokus:

“Cash costs me a lot of money to handle. I run a clean business. Only those who run the black market are interested in cash.

Ellburg put his foot down against cash payment as early as 2014. The card advocate from the capital’s fashionable restaurant scene is the only one of the cash-free players we have contacted who wanted to have a chat with Finansfokus. But Ellburg also made it clear that we should rather talk to those who still use cash – and ask why on earth they do it.

“I was the first in Norway to issue a press release stating that I do not accept cash. When older people have come and told me that they have been to the ATM to withdraw money, I have explained that there is no difference between entering the code in the ATM and entering it at a bank terminal in the restaurant,” he says.

Motive #2: Financial Resilience

Besides ensuring that people are not excluded from participating in the economy, the new amendment has another important goal in mind: to provide the economy with greater financial resilience. In April, a press release from the Ministry of Justice and Public Security highlighted the importance of cash as an “always on” payment option, ensuring Norway’s economy will not be rendered completely inaccessible in the event of “prolonged power outages, system failure or digital attacks against payment systems and banks”.

The Norwegian Directorate for Civil Protection even recommends people to have some amounts of cash at all times in case digital forms of payment stop working — something that appears to be happening with increasing frequency. This echoes a similar message issued a couple of years ago by a Finnish central bank official. In October 2022, Päivi Heikkinen, the Head of the Payment Systems Department and Chief Cashier at the Bank of Finland warned that households in Finland should make sure they have some cash on hand, just in case the country’s payments system goes down.

“More payment methods bring resilience,” said Heikkinen. “If a single payment method sometimes does not work, then we have other payment methods at our disposal. Cash still plays a very important role here.”

A Growing Trend

In another neck of the Scandinavian woods, the world’s oldest central bank, Sweden’s Riksbank, keeps sounding the alarm about the fragility of cashless economies, as we reported in May:

Digitalization… makes payments “more vulnerable to cyber attacks and disruptions to the power grid and data communication,” the bank points out. At the same time, the geopolitical developments of the past few years required “Sweden to have strong civil defense.” The developments suggested “that we should concentrate more than before on the challenges of digitalization.”

Put another way, cash does not crash. It does not fail in a power cut or seize up during a cyber attack (though, of course, ATMs might). By contrast, digital payment systems need a stable and continuous internet connection to process transactions. When these connections fail, the result is often chaos. Digital payment outages have caused significant disruption in a host of countries in recent years, including the US, the UK, Australia, Indonesia, Germany, Canada, Spain and Norway. Generally speaking, the more cashless the country, the greater the disruption.

Since that post went up, the world has suffered an even more disruptive payments outage. In July, a content update by the cyber-security firm CrowdStrike caused millions of Microsoft systems around the world to crash, bringing the operating systems of banks, payment card firms, airlines, hospitals, NHS clinics, retailers and hospitality businesses to a standstill. Businesse were faced with a stark choice: go cash-only, or close until the systems came back online.

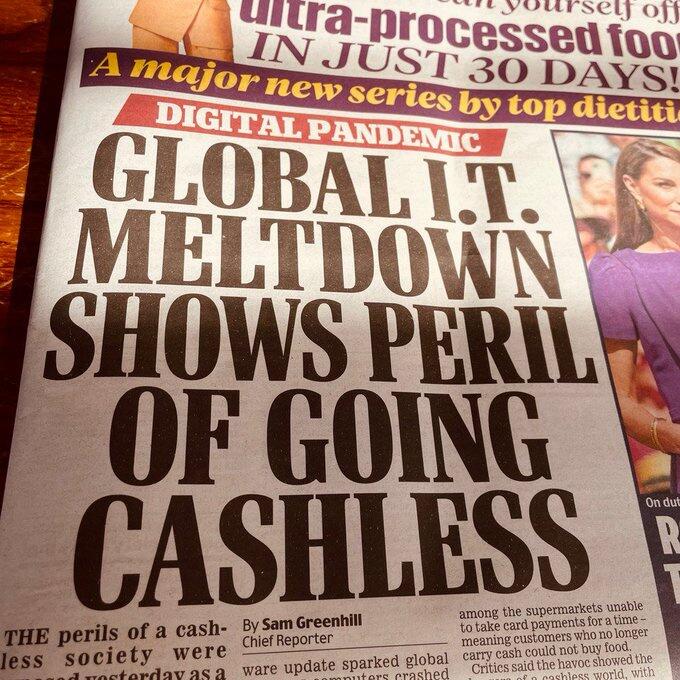

Such was the scale of the resulting disruption that even stalwart British media outlets like The Sun, The Times, The Guardian and The Mail ran articles on how the global IT outage had underscored the fragility of a cashless society. The Daily Mail plastered the message across its front page:

The digital payment outages didn’t stop there; they just keep on coming. On September 12, 250,000 card terminals in Germany — the equivalent of one-in-four of the country’s devices — stopped working, according to FAZ. Once again, the cause of the outage appears to be a software glitch, this time affecting the payment service provider Telecash. On the same day, outages were also reported in the Netherlands.

Protecting the Right to Use Cash: A Growing European Trend

In recent years a growing number of countries in Europe have passed or proposed legislation to protect the right of citizens to use cash as payment. They include Switzerland and Austria, two countries where cash is still very much King, as well as Slovakia, where the Robert Fico government last year passed an amendment to the constitution intended to protect physical payments from a future in which the digital euro becomes mandatory.

Back in Sweden, which is arguably even more cashless than Norway, the Riksbank, like its Norwegian counterpart, has called on the government to adopt urgent measures to strengthen cash’s role as a means of payment. Late last year, the central bank echoed a point we have been making for the past few years: “it is not enough to simply take measures to strengthen the availability of cash through withdrawal requirements and new depots, it must also be usable.”

That means taking a leaf out of neighbouring Norway’s book and adopting legislation that makes it much harder for retail outlets to reject cash payments. In a 14-page response to a parliamentary inquiry on the State’s role in payments, the Riksbank warned that “legislation on cash needs to be tightened up immediately” and “political decisions are needed urgently so that everyone can pay”:

“Cash is essential for digitally and financially excluded consumers. Cash is also the only payment instrument that can be used independently of electricity and telecommunications and is therefore important for Sweden’s emergency preparedness. There is no reason or time to wait for a new review, as the Inquiry infers. There is a considerable risk that cash will be further marginalised and that in the near future it can no longer be used for essential purchases. The Riksbank therefore proposes legislative amendments regarding the possibility of paying cash for essential goods and an obligation for banks to accept cash deposits from consumers”…

The Riksbank does not share the Inquiry’s assessment that, with regard to legal tender, the

legislator can wait to introduce even stronger obligations to accept cash until a new review of

the status of cash and access to cash has been carried out. In the Riksbank’s opinion, the Inquiry should have submitted legislative proposals that strengthen the position of cash even

more.

The inquiry itself concluded that Sweden’s shift toward a cashless society may have finally reached the outer limits of what is possible — at least for the “foreseeable future.”

“The use of cash for payment purposes has gradually declined over a longer period of time and is now comparatively low,” the inquiry reported, before adding that demand for cash has ‘remained virtually unchanged’ over the past five years. “Analysts have concluded that the direction of travel is clearly towards (in principle) a cashless society, especially in Sweden. The statistics, however, do not point to such a development, or indeed… that this will occur in the foreseeable future.”

Now, the central banks of both Sweden and Norway have the unenviable task of trying to slow or even reverse the mass abandonment of cash that they themselves helped set in motion. They will have their work cut out given that so much of their respective countries’ cash infrastructure — in particular private banks’ branch networks, ATMs and the distribution services offered by cash handling companies — has been allowed to wither over recent years.

It also remains to be seen whether enough Swedish and Norwegian citizens are prepared to re-embrace cash if it is made more available and easier to use. As in many countries, demand for cash in Norway has risen slightly over the past year with the number of withdrawals at ATMs ticking up, according to Norges Bank. But is this a sustainable trend? As payment technologies have advanced this century, most Norwegian and Swedish citizens have embraced the speed, ease and convenience of digital payments. But they were also nudged in that direction.

By 2016, Sweden’s commercial banks had made 60% of their branches cashless, as a 2019 Riksbank working paper documents. This made it much more difficult for citizens to access cash and for businesses to deposit it, which in turn accelerated the uptake of digital payments and the abandonment of cash. The Riksbank did its part by withdrawing many of Sweden’s large denomination notes from circulation. Now, it is trying to halt, or at least slow, the country’s onward march toward a cashless future.

Time is of the essence. As the central bank warns, if urgent action isn’t taken to fortify Sweden’s cash infrastructure, it will soon be too late:

[T]here are already such problems with cash and cash handling that there is reason to immediately tighten legislation to safe guard the position of cash and access to cash services. If the state waits until cash and cash services are further phased out, this could lead to a situation where it is too late to take action, or there is a risk that operators will be forced to go back and reinvest in equipment and systems.

Given Norway and Sweden have gone further than most countries in removing cash from the economy, the fact they are both now warning about the dangers and vulnerabilities of a fully cashless economy as well as the urgent need to protect both access to and use of cash should be taken very seriously — not just within their borders but far beyond them.

Sourced from ZeroHedge

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Telegram, HIVE, Minds, MeWe, Twitter – X and Gab.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Norway, One Of World’s Most Cashless Economies, Just Made It A Lot Easier To Pay With Cash"