By Tyler Durden

By Tyler Durden

Global government debt is projected to hit $97.1 trillion this year, a 40% increase since 2019.

During the COVID-19 pandemic, governments introduced sweeping financial measures to support the job market and prevent a wave of bankruptcies. However, this has exposed vulnerabilities as higher interest rates are amplifying borrowing costs.

In the graphic below, Visual Capitalist’s Niccolo Conte and Dorothy Neufeld show global debt by country in 2023, based on projections from the International Monetary Fund (IMF).

Debt by Country in 2023

Below, we rank countries by their general government gross debt, or the financial liabilities owed by each country:

| Country | Gross Debt (B) | % of World Total | Debt to GDP |

|---|---|---|---|

| ???????? U.S. | $33,228.9 | 34.2% | 123.3% |

| ???????? China | $14,691.7 | 15.1% | 83.0% |

| ???????? Japan | $10,797.2 | 11.1% | 255.2% |

| ???????? UK | $3,468.7 | 3.6% | 104.1% |

| ???????? France | $3,353.9 | 3.5% | 110.0% |

| ???????? Italy | $3,141.4 | 3.2% | 143.7% |

| ???????? India | $3,056.7 | 3.1% | 81.9% |

| ???????? Germany | $2,919.3 | 3.0% | 65.9% |

| ???????? Canada | $2,253.3 | 2.3% | 106.4% |

| ???????? Brazil | $1,873.7 | 1.9% | 88.1% |

| ???????? Spain | $1,697.5 | 1.7% | 107.3% |

| ???????? Mexico | $954.6 | 1.0% | 52.7% |

| ???????? South Korea | $928.1 | 1.0% | 54.3% |

| ???????? Australia | $875.9 | 0.9% | 51.9% |

| ???????? Singapore | $835.0 | 0.9% | 167.9% |

| ???????? Belgium | $665.2 | 0.7% | 106.0% |

| ???????? Argentina | $556.5 | 0.6% | 89.5% |

| ???????? Indonesia | $552.8 | 0.6% | 39.0% |

| ???????? Netherlands | $540.9 | 0.6% | 49.5% |

| ???????? Poland | $419.4 | 0.4% | 49.8% |

| ???????? Greece | $407.2 | 0.4% | 168.0% |

| ???????? Türkiye | $397.2 | 0.4% | 34.4% |

| ???????? Russia | $394.8 | 0.4% | 21.2% |

| ???????? Austria | $393.6 | 0.4% | 74.8% |

| ???????? Egypt | $369.3 | 0.4% | 92.7% |

| ???????? Switzerland | $357.7 | 0.4% | 39.5% |

| ???????? Thailand | $314.5 | 0.3% | 61.4% |

| ???????? Israel | $303.6 | 0.3% | 58.2% |

| ???????? Portugal | $299.4 | 0.3% | 108.3% |

| ???????? Malaysia | $288.3 | 0.3% | 66.9% |

| ???????? South Africa | $280.7 | 0.3% | 73.7% |

| ???????? Pakistan | $260.9 | 0.3% | 76.6% |

| ???????? Saudi Arabia | $257.7 | 0.3% | 24.1% |

| ???????? Ireland | $251.7 | 0.3% | 42.7% |

| ???????? Philippines | $250.9 | 0.3% | 57.6% |

| ???????? Finland | $225.0 | 0.2% | 73.6% |

| ???????? Norway | $204.5 | 0.2% | 37.4% |

| ???????? Colombia | $200.1 | 0.2% | 55.0% |

| ???????? Taiwan | $200.0 | 0.2% | 26.6% |

| ???????? Sweden | $192.9 | 0.2% | 32.3% |

| ???????? Romania | $178.7 | 0.2% | 51.0% |

| ???????? Bangladesh | $175.9 | 0.2% | 39.4% |

| ???????? Ukraine | $152.8 | 0.2% | 88.1% |

| ???????? Czech Republic | $152.2 | 0.2% | 45.4% |

| ???????? Nigeria | $151.3 | 0.2% | 38.8% |

| ???????? UAE | $149.7 | 0.2% | 29.4% |

| ???????? Vietnam | $147.3 | 0.2% | 34.0% |

| ???????? Hungary | $140.0 | 0.1% | 68.7% |

| ???????? Chile | $132.2 | 0.1% | 38.4% |

| ???????? Denmark | $126.7 | 0.1% | 30.1% |

| ???????? Iraq | $125.5 | 0.1% | 49.2% |

| ???????? Algeria | $123.5 | 0.1% | 55.1% |

| ???????? New Zealand | $115.0 | 0.1% | 46.1% |

| ???????? Iran | $112.1 | 0.1% | 30.6% |

| ???????? Morocco | $102.7 | 0.1% | 69.7% |

| ???????? Qatar | $97.5 | 0.1% | 41.4% |

| ???????? Peru | $89.7 | 0.1% | 33.9% |

| ???????? Angola | $79.6 | 0.1% | 84.9% |

| ???????? Kenya | $79.1 | 0.1% | 70.2% |

| ???????? Slovakia | $75.4 | 0.1% | 56.7% |

| ???????? Dominican Republic | $72.1 | 0.1% | 59.8% |

| ???????? Ecuador | $65.9 | 0.1% | 55.5% |

| ???????? Sudan | $65.5 | 0.1% | 256.0% |

| ???????? Ghana | $65.1 | 0.1% | 84.9% |

| ???????? Kazakhstan | $60.7 | 0.1% | 23.4% |

| ???????? Ethiopia | $59.0 | 0.1% | 37.9% |

| ???????? Bahrain | $54.5 | 0.1% | 121.2% |

| ???????? Costa Rica | $53.9 | 0.1% | 63.0% |

| ???????? Croatia | $51.2 | 0.1% | 63.8% |

| ???????? Uruguay | $47.0 | 0.0% | 61.6% |

| ???????? Jordan | $46.9 | 0.0% | 93.8% |

| ???????? Slovenia | $46.8 | 0.0% | 68.5% |

| ???????? Côte d’Ivoire | $45.1 | 0.0% | 56.8% |

| ???????? Panama | $43.5 | 0.0% | 52.8% |

| ???????? Myanmar | $43.0 | 0.0% | 57.5% |

| ???????? Oman | $41.4 | 0.0% | 38.2% |

| ???????? Tunisia | $39.9 | 0.0% | 77.8% |

| ???????? Serbia | $38.5 | 0.0% | 51.3% |

| ???????? Bolivia | $37.8 | 0.0% | 80.8% |

| ???????? Tanzania | $35.8 | 0.0% | 42.6% |

| ???????? Uzbekistan | $31.7 | 0.0% | 35.1% |

| ???????? Zimbabwe | $30.9 | 0.0% | 95.4% |

| ???????? Belarus | $30.4 | 0.0% | 44.1% |

| ???????? Guatemala | $29.1 | 0.0% | 28.3% |

| ???????? Lithuania | $28.7 | 0.0% | 36.1% |

| ???????? El Salvador | $25.8 | 0.0% | 73.0% |

| ???????? Uganda | $25.3 | 0.0% | 48.3% |

| ???????? Senegal | $25.2 | 0.0% | 81.0% |

| ???????? Cyprus | $25.2 | 0.0% | 78.6% |

| ???????? Luxembourg | $24.6 | 0.0% | 27.6% |

| ???????? Hong Kong SAR | $23.5 | 0.0% | 6.1% |

| ???????? Bulgaria | $21.7 | 0.0% | 21.0% |

| ???????? Cameroon | $20.6 | 0.0% | 41.9% |

| ???????? Mozambique | $19.7 | 0.0% | 89.7% |

| ???????? Puerto Rico | $19.6 | 0.0% | 16.7% |

| ???????? Nepal | $19.3 | 0.0% | 46.7% |

| ???????? Latvia | $18.9 | 0.0% | 40.6% |

| ???????? Iceland | $18.7 | 0.0% | 61.2% |

| ???????? Paraguay | $18.1 | 0.0% | 40.9% |

| ???????? Lao P.D.R. | $17.3 | 0.0% | 121.7% |

| ???????? Honduras | $15.7 | 0.0% | 46.3% |

| ???????? Papua New Guinea | $15.7 | 0.0% | 49.5% |

| ???????? Trinidad and Tobago | $14.6 | 0.0% | 52.5% |

| ???????? Albania | $14.5 | 0.0% | 62.9% |

| ???????? Republic of Congo | $14.1 | 0.0% | 97.8% |

| ???????? Azerbaijan | $14.1 | 0.0% | 18.2% |

| ???????? Yemen | $14.0 | 0.0% | 66.4% |

| ???????? Jamaica | $13.6 | 0.0% | 72.3% |

| ???????? Mongolia | $13.1 | 0.0% | 69.9% |

| ???????? Burkina Faso | $12.7 | 0.0% | 61.2% |

| ???????? Gabon | $12.5 | 0.0% | 64.9% |

| ???????? Georgia | $11.9 | 0.0% | 39.6% |

| ???????? Mauritius | $11.8 | 0.0% | 79.7% |

| ???????? Armenia | $11.8 | 0.0% | 47.9% |

| ???????? Bahamas | $11.7 | 0.0% | 84.2% |

| ???????? Mali | $11.0 | 0.0% | 51.8% |

| ???????? Malta | $11.0 | 0.0% | 54.1% |

| ???????? Cambodia | $10.9 | 0.0% | 35.3% |

| ???????? Benin | $10.6 | 0.0% | 53.0% |

| ???????? Malawi | $10.4 | 0.0% | 78.6% |

| ???????? Estonia | $9.0 | 0.0% | 21.6% |

| ???????? Democratic Republic of Congo | $9.0 | 0.0% | 13.3% |

| ???????? Rwanda | $8.8 | 0.0% | 63.3% |

| ???????? Namibia | $8.5 | 0.0% | 67.6% |

| ???????? Madagascar | $8.5 | 0.0% | 54.0% |

| ???????? Niger | $8.3 | 0.0% | 48.7% |

| ???????? North Macedonia | $8.2 | 0.0% | 51.6% |

| ???????? Bosnia and Herzegovina | $7.7 | 0.0% | 28.6% |

| ???????? Maldives | $7.7 | 0.0% | 110.3% |

| ???????? Guinea | $7.3 | 0.0% | 31.6% |

| ???????? Nicaragua | $7.2 | 0.0% | 41.5% |

| ???????? Barbados | $7.2 | 0.0% | 115.0% |

| ???????? Togo | $6.1 | 0.0% | 67.2% |

| ???????? Kyrgyz Republic | $6.0 | 0.0% | 47.0% |

| ???????? Moldova | $5.6 | 0.0% | 35.1% |

| ???????? Chad | $5.4 | 0.0% | 43.2% |

| ???????? Kuwait | $5.4 | 0.0% | 3.4% |

| ???????? Mauritania | $5.1 | 0.0% | 49.5% |

| ???????? Haiti | $5.1 | 0.0% | 19.6% |

| ???????? Guyana | $4.9 | 0.0% | 29.9% |

| ???????? Montenegro | $4.6 | 0.0% | 65.8% |

| ???????? Fiji | $4.6 | 0.0% | 83.6% |

| ???????? Turkmenistan | $4.2 | 0.0% | 5.1% |

| ???????? Tajikistan | $4.0 | 0.0% | 33.5% |

| ???????? Botswana | $3.9 | 0.0% | 18.7% |

| ???????? Equatorial Guinea | $3.8 | 0.0% | 38.3% |

| ???????? Suriname | $3.8 | 0.0% | 107.0% |

| ???????? South Sudan | $3.8 | 0.0% | 60.4% |

| ???????? Bhutan | $3.3 | 0.0% | 123.4% |

| ???????? Aruba | $3.2 | 0.0% | 82.9% |

| ???????? Sierra Leone | $3.1 | 0.0% | 88.9% |

| ???????? Cabo Verde | $2.9 | 0.0% | 113.1% |

| ???????? Burundi | $2.3 | 0.0% | 72.7% |

| ???????? Liberia | $2.3 | 0.0% | 52.3% |

| ???????? Kosovo | $2.2 | 0.0% | 21.3% |

| ???????? Eswatini | $2.0 | 0.0% | 42.4% |

| ???????? Belize | $1.9 | 0.0% | 59.3% |

| ???????? Saint Lucia | $1.8 | 0.0% | 74.2% |

| ???????? Gambia | $1.7 | 0.0% | 72.3% |

| ???????? Djibouti | $1.6 | 0.0% | 41.8% |

| ???????? Antigua and Barbuda | $1.6 | 0.0% | 80.5% |

| ???????? San Marino | $1.5 | 0.0% | 74.0% |

| ???????? Guinea-Bissau | $1.5 | 0.0% | 73.9% |

| ???????? Lesotho | $1.5 | 0.0% | 61.3% |

| ???????? Andorra | $1.4 | 0.0% | 37.7% |

| ???????? Central African Republic | $1.4 | 0.0% | 50.1% |

| ???????? Seychelles | $1.3 | 0.0% | 60.8% |

| ???????? Saint Vincent and the Grenadines | $0.9 | 0.0% | 86.2% |

| ???????? Grenada | $0.8 | 0.0% | 60.2% |

| ???????? Dominica | $0.7 | 0.0% | 93.9% |

| ???????? Saint Kitts and Nevis | $0.6 | 0.0% | 53.2% |

| ???????? Vanuatu | $0.5 | 0.0% | 46.8% |

| ???????? Comoros | $0.5 | 0.0% | 33.3% |

| ???????? São Tomé and Príncipe | $0.4 | 0.0% | 58.5% |

| ???????? Solomon Islands | $0.4 | 0.0% | 22.2% |

| ???????? Brunei Darussalam | $0.3 | 0.0% | 2.3% |

| ???????? Samoa | $0.3 | 0.0% | 36.2% |

| ???????? Timor-Leste | $0.3 | 0.0% | 16.4% |

| ???????? Palau | $0.2 | 0.0% | 85.4% |

| ???????? Tonga | $0.2 | 0.0% | 41.1% |

| ???????? Micronesia | $0.1 | 0.0% | 12.5% |

| ???????? Marshall Islands | $0.1 | 0.0% | 18.1% |

| ???????? Nauru | <$0.1 | 0.0% | 29.1% |

| ???????? Kiribati | <$0.1 | 0.0% | 13.1% |

| ???????? Tuvalu | <$0.1 | 0.0% | 8.0% |

| ???????? Macao SAR | <$0.1 | 0.0% | 0.0% |

| ???? World | $97,129.8 | 100% | 93.0% |

With $33.2 trillion in government debt, the U.S. makes up over a third of the world total.

Given the increasing debt load, the cost of servicing this debt now accounts for 20% of government spending. It is projected to reach $1 trillion by 2028, surpassing the total spent on defense.

Activist Post is Google-Free — We Need Your Support

Contribute Just $1 Per Month at Patreon or SubscribeStar

The world’s third-biggest economy, Japan, has one of the highest debt to GDP ratios, at 255%. Over the last two decades, its national debt has far exceeded 100% of its GDP, driven by an aging population and social security expenses.

In 2023, Egypt faces steep borrowing costs, with 40% of revenues going towards debt repayments. It has the highest debt on the continent.

Like Egypt, several emerging economies are facing strain. Lebanon has been in default since 2020, and Ghana defaulted on the majority of its external debt—debt owed to foreign lenders—in 2022 amid a deepening economic crisis.

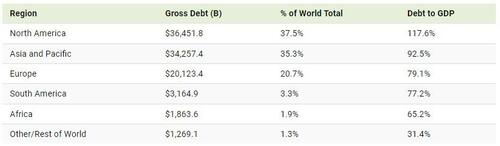

Global Debt: A Regional Perspective

How does debt compare on a regional level in 2023?

We can see that North America has both the highest debt and debt to GDP compared to other regions. Just as U.S. debt has ballooned, so has Canada’s—ranking as the 10th-highest globally in government debt outstanding.

Across Asia and the Pacific, debt levels hover close to North America.

At 3.3% of the global total, South America has $3.2 trillion in debt. As inflation has trended downwards, a handful of governments have already begun cutting interest rates. Overall, public debt levels are projected to stay elevated across the region.

Debt levels have also risen rapidly in Africa, with an average 40% of public debt held in foreign currencies—leaving it exposed to exchange rate fluctuations. Another challenge is that interest rates are also higher across the region compared to advanced economies, increasing debt-servicing costs.

By 2028, the IMF projects that global public debt will exceed 100% of GDP, hitting levels only seen during the pandemic.

Source: ZeroHedge

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Minds, MeWe, Twitter – X, Gab, and What Really Happened.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Visualizing $97 Trillion Of Global Debt In 2023"