By Tyler Durden

By Tyler Durden

A month ago, we confirmed the identity of the “mystery” gold-buyer who had been suddenly hording the precious metal in recent months.

Specifically, we identified China as the hidden whale buying the barbarous relic when all around them are decrying its inflation-hedging help, remarking at the time that for China, the need to find an alternative to dollars, which dominate its reserves, has rarely been greater.

Tensions with the US have been high since measures were taken against its semiconductor firms, while Russia’s invasion of Ukraine has demonstrated Washington’s willingness to sanction central bank reserves. In other words, now that the US has shown it is ready to weaponize the dollar, any USD reserves held by the Fed, Western banks or any other counterparty, could and will be promptly confiscated if China does something unpalatable… like invading Taiwan. Which is why China is desperately seeking money without counterparty risk. Here it has just two choices: crypto or gold. For now, it has picked the latter.

Today, commodities strategists at TD Securities agree that the gold whale could be the Chinese official sector.

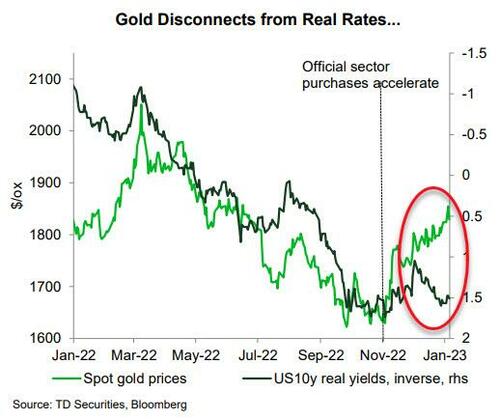

“The rally in gold prices over the past two months has defied analyst expectations for continued weakness, including TD Securities. Yet, we see little evidence that the rise in gold prices is associated with a changing macro narrative. Given the bearish macro backdrop, speculative interest in gold has remained exceptionally lackluster as the world barrels towards a recession,” senior commodity strategist Daniel Ghali writes.

“Armed with a flows-based approach, we present strong evidence that behemoth Chinese and official sector purchases may have single-handedly catalyzed a $150/oz mispricing in gold markets,” he adds.

Gold and Silver: Industry-Best Customer Service at Money Metals (Ad)

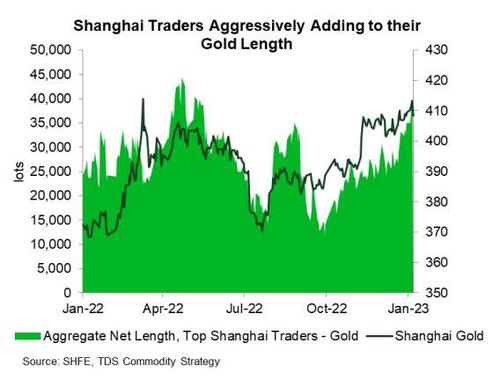

Chinese traders have been the only directly observable underlying buyers. Our tracking of the top ten participants in Shanghai highlights a notable increase in net length from this cohort, equivalent to 100 tonnes in notional gold since December 20th. This was primarily driven by more than 16k SHFE lots of new longs acquired over this timeframe, continuing the trend of notable rise in Shanghai gold length since early November. The pace of gold purchases from Shanghai traders has yet to show any sign of slowing as traders’ net length approaches last-twelve-month highs.

Further, signs of Chinese interest in gold are also apparent in the yellow metal’s microstructure. Chinese gold premiums remain extremely elevated by historical standards, which points to strong underlying demand for the yellow metal.

Easiest way to get your first Bitcoin (Ad)

While premiums are below the extreme levels seen over the summer of 2022, when Mainland gold supply was constrained by lackluster quotas, their recent strength is rather a symptom of outstanding demand.

In turn, rather than viewing gold’s resilience as a function of a changing macroeconomic narrative, Chinese demand at a massive scale is likely the main culprit behind the strong price action that has defied analyst and trader views over past months. This helps to explain the disconnect between gold and real rates, in favor of a tighter relationship with currencies.

However, Ghali notes that “what is less clear is what has driven these massive purchases.”

The TD Securities’ strategist has a few ideas:

- Reserve Currency Ambitions: A contingent of market participants has suggested that gold is gaining market share as a reserve asset. After all, USD valuations have moved to extremes following the build-up in USD cash and associated stagflation hedges. European data surprises are surging with growth expectations on the rise as extremely mild weather helped the region fare with the ongoing energy shock, at the same time as a fast-paced Chinese reopening bolsters rest-of-world growth — factors which are all in support of a cyclical peak in USD value. Most importantly, however, is the rise in perceived sanctions risks associated with USD reserves held in the East, following the introduction of Western sanctions on Russia this year; these have likely bolstered official purchases. This is consistent with official purchases announced by Turkey, Qatar and other nations. Market participants have pointed to the rapprochement between China and Gulf nations to support the thesis that demand for USD reserves is indeed declining. President Xi attended the very first China-Arab States Summit in history, seen as an echo to FDR’s meeting with King Abdul Aziz Ibn Saud in 1945 which cemented a new paradigm amounting to US security guarantees exchanged for oil sold in US dollars. Today, US incentives to provide security are likely to decline over the coming decade along with Western oil demand, whereas China’s growing demand for energy is likely to solidify trade with GCC nations over this timeframe. President Xi also spoke of a new paradigm — one of all-dimensional energy cooperation, which will entirely rely on RMB settlement for oil and gas trade over the next five years. While the long-term resilience of this thesis is difficult to rank in the present, this narrative is certainly consistent with price action associated with a steep accumulation of gold in support of the renminbi.

- Hedging Sanctions: We previously discussed the rise in perceived sanctions risks associated with USD reserves held in the East, following the introduction of Western sanctions on Russia this year. A less likely scenario worth considering is whether a steep increase in gold reserves could be associated with the building of a sanction-evasion war chest tied to China’s geopolitical ambitions. Tensions between China and Taiwan have come to a boil over the past year with a heightened sense of fear of a military confrontation since the war in Ukraine. In turn, some market participants could plausibly fear that the steep accumulation of gold is preceding a military confrontation, but there is little concrete evidence to support this. Further, one could argue that this is inconsistent with an apparent détente with the West, highlighted by the recent lifting of China’s embargo on Australian coal and a notable shift in China’s foreign policy communications.

- Chinese Reopening Demand: Our tracking of Shanghai gold positioning appears to loosely correlate with the frequency of Chinese reopening-themed news stories. Official sector purchases, however, are likely to have correlated more closely. After China’s widespread Q2 lockdowns had depressed jewellery, bar and coin demand, it is plausible that the comeback in sales observed during Q3 has gathered steam amid robust pent-up demand. While this is less appealing than a grandiose narrative about a change in geopolitical regimes, it is also consistent with the sharp recovery in gold demand observed with urban Indian consumers over the past year and with price action associated with a surge in Chinese demand. However, this thesis would clearly be more transient and would likely imply that gold prices are subject to a steep consolidation once Chinese pent-up demand is satiated and reverts to normality. This scenario would increase risks of a consolidation towards $1700/oz or below, given gold’s steep overvaluation relative to its recent historical relationship with real rates.

- Restocking for Chinese New Year: Similarly, Chinese New Year has tended to seasonally buoy gold prices. Several market participants anticipate this trend, and it’s plausible that large pent-up demand for gold associated with Chinese New Year celebrations are tied to the end of Zero-Covid. Over the past five years, gold prices have rallied from November to year-end in every single instance, averaging a 3.25% gain. The exceptional 10.7% gain in gold prices observed in this time horizon for 2022 could plausibly be tied to extremely elevated demand tied to these celebrations. Unfortunately, we find little concrete evidence to support this view. Nonetheless, this scenario would also likely be associated with a sharp slump in demand as Chinese New Year approaches.

Lacking additional data, we don’t find sufficient evidence at this time to bolster our conviction on what has driven Chinese purchases. The massive demand impulse from the official sector certainly fits with China’s reserve currency ambitions and with the accumulation of a sanctions war chest, but the latter appears inconsistent with an apparent détente in foreign policy.

While central bank buying rarely drives sustainable gold rallies, it can provide an important pillar of support when prices fall. The precious metal has been under pressure this year from the Federal Reserve’s aggressive monetary tightening, though it has held up relatively well against moves in the dollar and Treasury yields.

“As deglobalisation accelerates, the non-G-10 nations are expected to ‘re-commoditize’ and ramp up gold holdings,” said Nicky Shiels, head of strategy at MKS PAMP SA.

Finally, as Zoltan Pozsar wrote most recently here (and in a must-read note last month), the role of gold may be changing as first Russia, then other countries (China) seek to force out the petrodollar and replace it with petrogold, a move which would finally lead to substantial price upside for the yellow metal which has gone nowhere in the past 2 years.

Remember Zoltan’s portfolio advice: Commodities should include three types of gold: yellow, black, and white. Yellow gold is gold bars. Black gold is oil. White gold is lithium for EVs.

Source: ZeroHedge

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "“A Sanctions-Evasion War-Chest Ahead Of Taiwan Invasion” – Why Is China Hoarding Gold Again?"