By Tyler Durden

By Tyler Durden

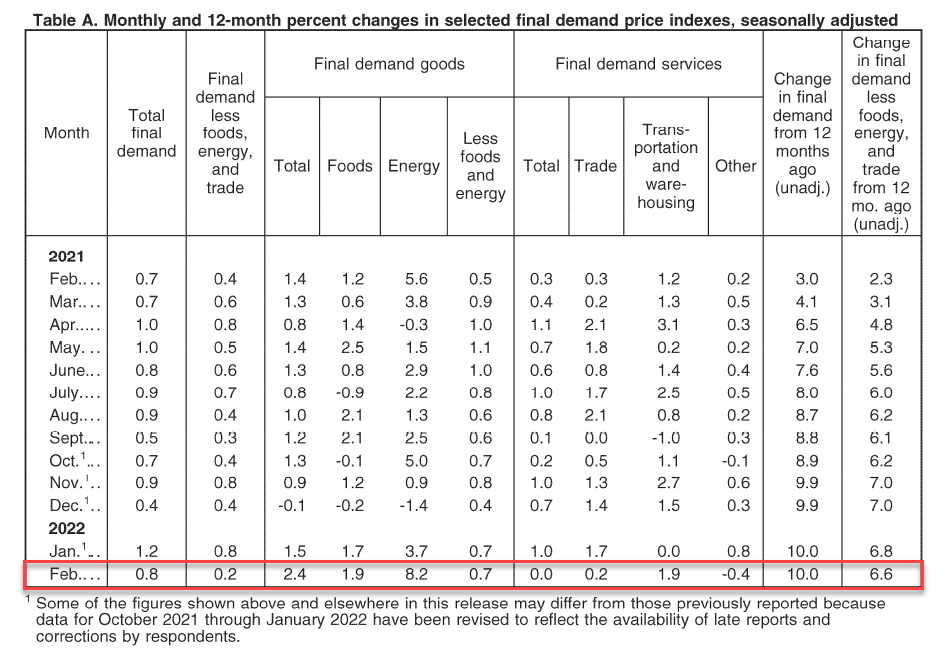

Following the far-hotter-than-expected CPI print, analysts expected Producer Prices to extend their acceleration, and they did rising 10.0% YoY in February (vs +9.7% YoY in January), hitting double-digits for the first time since Bloomberg data began.

Also notable is that January’s PPI data was revised higher, from +9.7% to +10.0% YoY.

This is the 21st straight month of MoM rising producer prices, and given the sustained upward pressure from the supply chain and intermediate demand, it doesn’t look like a transitory turn any time soon…

Nearly 40 percent of the February increase in prices for final demand goods can be attributed to the index for gasoline, which rose 14.8 percent.

Prices for diesel fuel, electric power, jet fuel, motor vehicles and equipment, and dairy products also advanced.

In contrast, the index for fresh and dry vegetables decreased 9.4 percent. Prices for beef and veal and for hot-rolled steel sheet and strip also moved lower.

PPI final demand services: prices for truck transportation of freight moved up 2.0 percent. The indexes for food and alcohol retailing, machinery and vehicle wholesaling, transportation of passengers (partial), and outpatient care (partial) also rose. Conversely, prices for portfolio management decreased 4.2 percent. The indexes for guestroom rental; apparel, jewelry, footwear, and accessories retailing; automobile retailing (partial); and residential real estate loans (partial) also declined.

And there appears to be a shortage of everything except financial advisors: prices for portfolio management decreased 4.2%.

Finally, the market is now pricing in 7 rate hikes for 2022…

Will today’s PPI prints push that even higher (and increase the odds of a 50bps hike in May following tomorrow’s hike) or lower as there was some dovish optimism, as core PPI printed lower than expected (+6.6% YoY vs +7.3% exp vs +6.8% YoY prior)?

Source: ZeroHedge

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "US Producer Prices Soar At Double Digits For First Time"