By Tyler Durden

By Tyler Durden

As the federal government steps in to bail out overleveraged borrowers in the commercial real estate space, a growing body of evidence is highlighting the fact that Congress’s ‘PPP’ lending program – despite the fact that it has been extended through Aug. 8 – still wasn’t enough to save many small business owners from ruin (though there was unsurprisingly no shortage of fraud).

A survey published by CreditCards.com shows that 35% of small-business owners were forced to dip into emergency savings to help tide their business or businesses over.

***

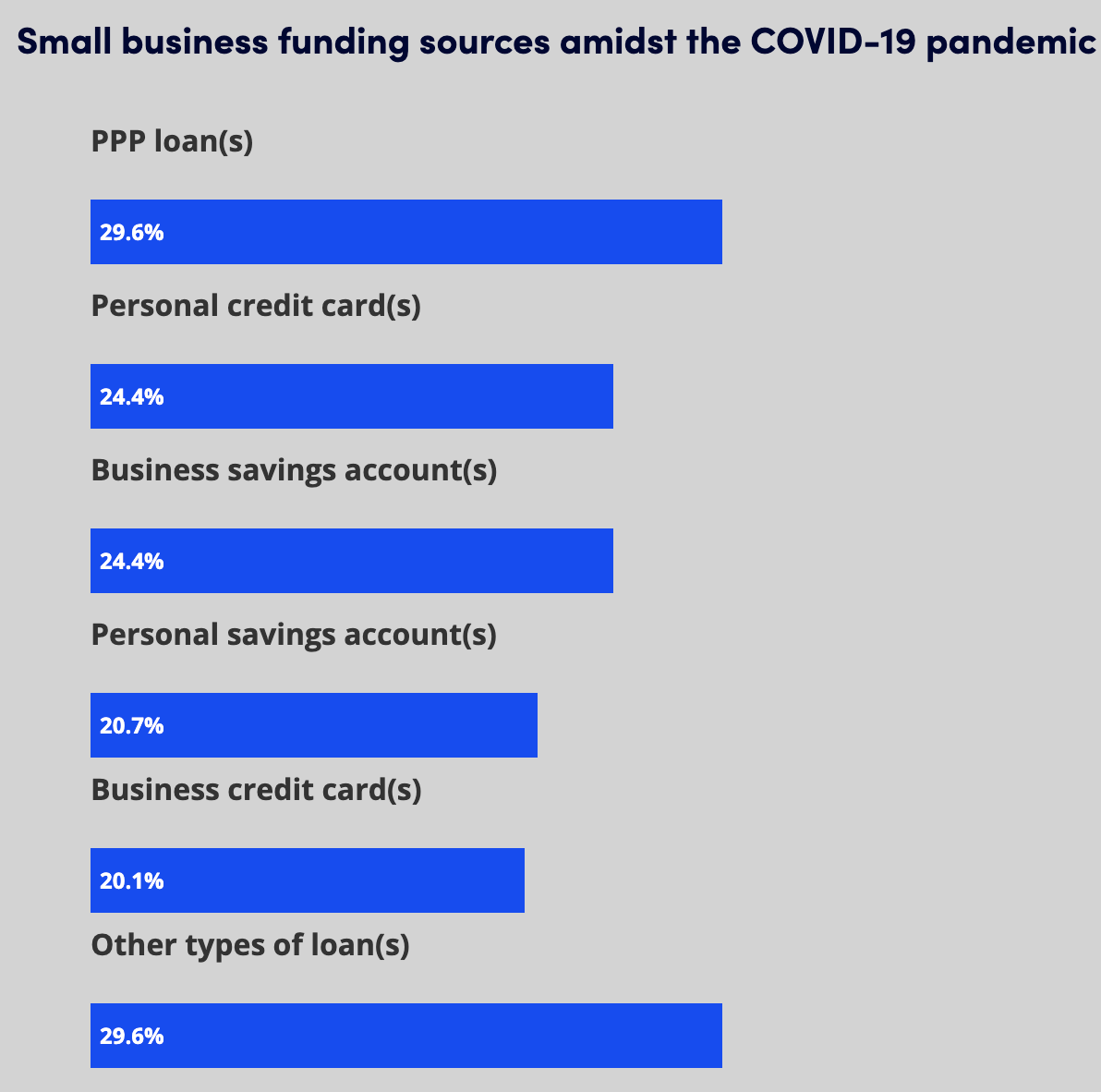

Our July 2020 Small Business Poll uncovered a worrisome fact – 35% of American small-business decision-makers have tapped into personal funds to finance their businesses since the pandemic struck. That includes those who have dipped into a personal savings account (21%), used a personal credit card (24%) or both (10%).

“It’s commendable how far these dedicated business owners are willing to go in search of their dreams,” says Ted Rossman, industry analyst at CreditCards.com. “I worry, however, about the debt they’re taking on, and how they’re potentially putting their personal finances at risk.”

Also notable, 38% of business leaders have turned to either business or personal credit cards during this time, with 20% of those polled leaning on business cards.

Paying off credit card debt can be stressful, but there’s a way to do so efficiently. Negotiating interest rates and paying more than the minimum are two ways to reduce the total time and amount of money repaid. “Many of the normal debt reduction tools are in shorter supply these days – for instance, 0% balance transfer offers have dried up due to worries about the economy. That’s why it’s so important to be creative and ask for a break,” Rossman added. Another good strategy: If you have multiple cards with balances and are able to put some money toward your debt, prioritize the highest interest rates in order to reduce the total interest expense.

Meanwhile, the single most popular form of funding was Paycheck Protection Program loans from the Small Business Administration, used by 30% of small businesses.

See: 177 Different Ways to Generate Extra Income

To stay afloat until 2021, small business decision-makers say they will need:

- An increase in sales (32%)

- Government assistance, such as stimulus funding (19%)

- Any type of loan (13%)

“I’m encouraged by the spirit behind these findings. Even in an incredibly difficult year, small businesses remain resilient and optimistic – they’re taking matters into their own hands. They’re important parts of our communities and our economy, and we’re rooting for them,” says Rossman.

Methodology

CreditCards.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. The total sample size was 499 small-business decision-makers. Fieldwork was undertaken from July 14-20, 2020. The survey was carried out online and meets rigorous quality standards. It employed a non-probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

* * *

Source: CreditCards.com

Article source: Zerohedge

Image: Pixabay

Subscribe to Activist Post for truth, peace, and freedom news. Send resources to the front lines of peace and freedom HERE! Follow us on SoMee, HIVE, Parler, Flote, Minds, and Twitter.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "35% Of Small Business Owners Tapped Personal Savings To Pay Rent, Wages During Pandemic"