By Tyler Durden

By Tyler Durden

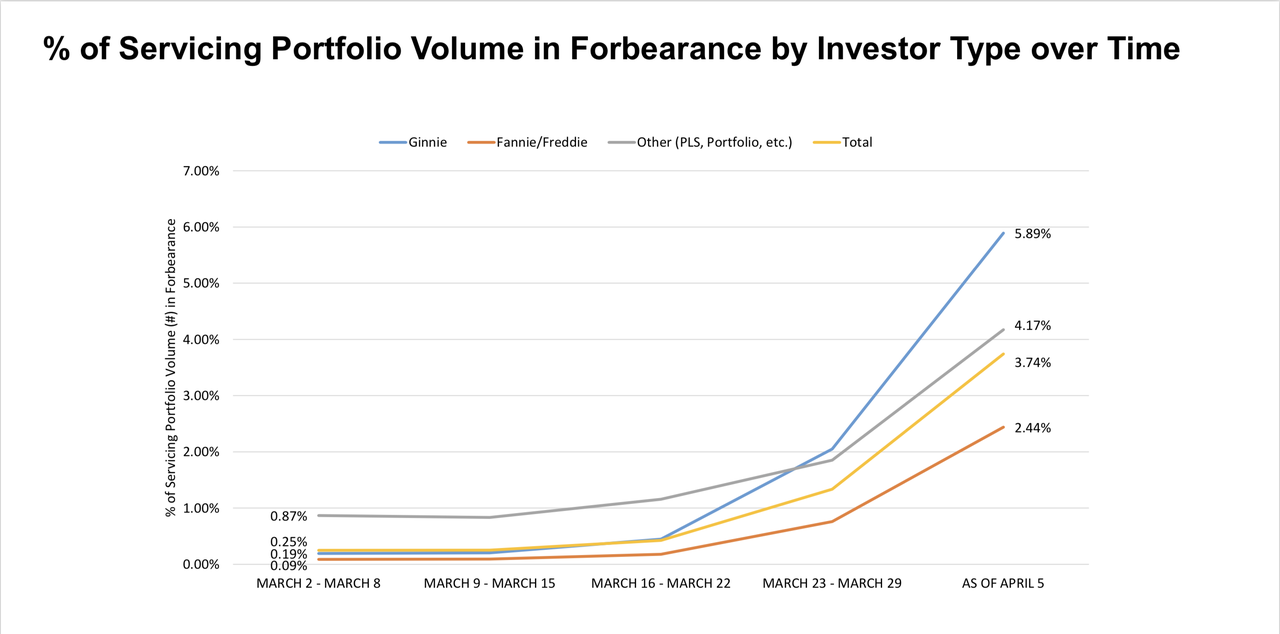

With unemployment claims hitting nearly 17 million over the last three weeks, the number of Americans applying for the government’s mortgage forbearance program under the COVID-19 relief plan spiked 73% for the week ending April 5 vs. the previous week – jumping from 2.73% to 3.74%, according to new data from the Mortgage Bankers Association.

For context, the total number of loans in forbearance was just 0.25% for the week of March 2 – an increase of 1,496% in just six weeks, with the number of borrowers in forbearance now topping 2 million according to CNBC.

Of the increase, borrowers with Ginnie Mae loans are in the worst shape – with requests jumping from 4.31% to 5.89%. Fannie Mae and Freddie Mac borrowers are doing ‘less bad’, with forbearance requests increasing from 1.69% to 2.44%.

“The nationwide shutdown of the economy to slow the spread of COVID-19 continues to create hardships for millions of households, and more are contacting their servicers for relief in accordance with the forbearance provisions under the CARES Act,” said MBA’s chief economist, Mike Fratantoni. “With mitigation efforts seemingly in place for at least several more weeks, job losses will continue and the number of borrowers asking for forbearance will likely to continue to rise at a rapid pace.”

Meanwhile, as we noted last night, JP Morgan is now raising borrowing standards for most new home loans as they move “to mitigate lending risk stemming from the novel coronavirus disruption.”

Starting Tuesday, customers applying for a new mortgage will need a credit score of at least 700, and will be required to make a down payment equal to 20% of the home’s value (something which we thought was the norm after the last financial crisis, but apparently lending conditions had eased quite a bit in the past decade), according to Reuters.

See: 177 Different Ways to Generate Extra Income

“Due to the economic uncertainty, we are making temporary changes that will allow us to more closely focus on serving our existing customers,” Amy Bonitatibus, chief marketing officer for JPMorgan Chase’s home lending business, told Reuters.

Other key findings from the BA’s latest Forbearance and Call Volume Survey:

- Total loans in forbearance grew relative to the prior week from 2.73% to 3.74%. For the week of March 2, only 0.25% of all loans were in forbearance.

- Forbearance requests as a percent of servicing portfolio volume (#) rose relative to the prior week to 2.43% from 1.36%.

- Weekly servicer call center volume

- As a percent of servicing portfolio volume (#), calls rose from 11.6% to 14.4%

- Hold times decreased from 13.0 minutes to 10.3 minutes

- Abandonment rates declined from 21% to 17%

- Average call length rose from 7.3 minutes to 7.5 minutes from 7.3 minutes

- Loans in forbearance as a share of servicing portfolio volume (#) as of April 5, 2020:

- Total: 3.74% (previous week: 2.73%)

- IMBs: 4.17% (previous week: 3.45%)

- Banks: 3.63% (previous week: 2.24%)

Meanwhile, homebuilders seem to think everything’s A-OK.

Source: ZeroHedge

Subscribe to Activist Post for truth, peace, and freedom news. Become an Activist Post Patron for as little as $1 per month at Patreon. Follow us on SoMee, Flote, Minds, Twitter, and HIVE.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Nearly 2 Million Struggling Homeowners Apply For Assistance As Forbearance Explosion Paints Dire Picture"