By Tyler Durden

By Tyler Durden

ATTOM Data Solutions has published its Q2 2019 U.S. Home Flipping Report, which states revenue from home flipping has plunged to an eight-year low.

According to Todd Teta, chief product officer at ATTOM, diminishing returns on home flips could be a sign that the real estate market is nearing a crisis.

Home flipping keeps getting less and less profitable, which is another marker that the post-recession housing boom is softening or may be coming to an end. Flipping houses is still a good business to be in and profits are healthy in most parts of the country. But push-and-pull forces in the housing market appear to be working less and less in investors’ favor. That’s leading to declining profits and a business that is nowhere near as good as it was a few years ago.

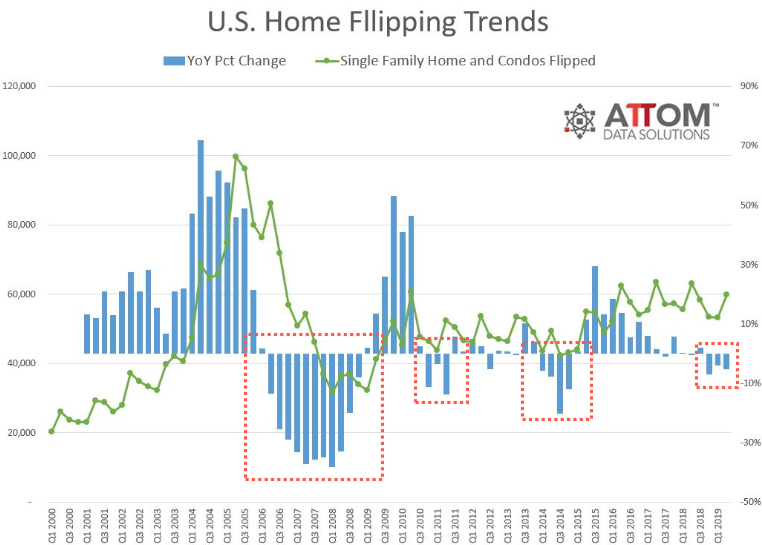

The report shows that 59,876 homes and condos were flipped in 2Q, up 12.4% QoQ, but down 5.2% YoY.

Homes flipped in the quarter represented 5.9% of all home sales, down from 7.2% in 1Q.

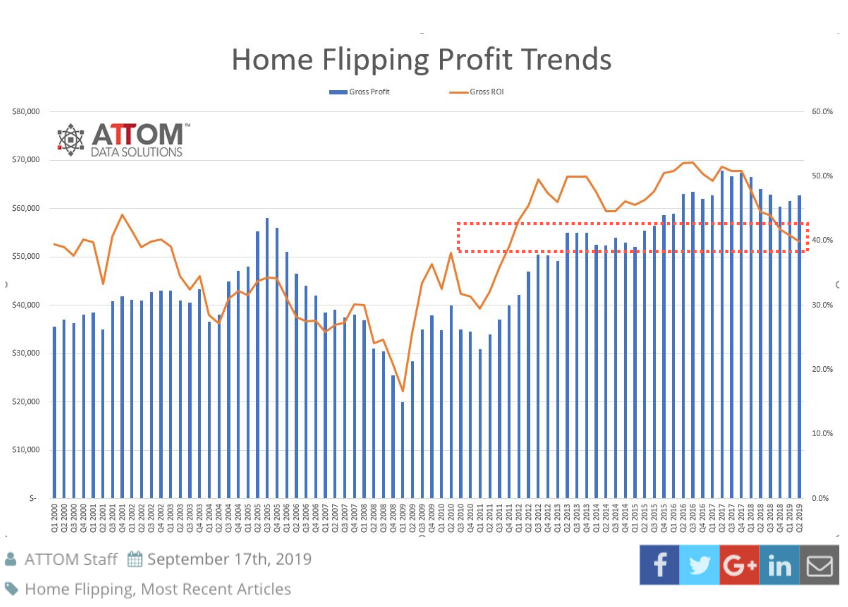

In the quarter, homes flipped generated a gross profit of $62,700, up 2% QoQ, but down 2% YoY. The $62,700 in 2Q translated into a 39.9% ROI, down from 40.9% ROI in 1Q.

Returns on home flips have fallen for six consecutive quarters and eight of the last ten, now reaching levels not seen since 4Q11.

But with returns at eight-year lows, investors, especially the mom-and-pop ones watching too much HGTV, were the ones flipping like crazy in 2Q. Flipping rates increased in 2Q YoY in 104 of 149 metropolitan statistical areas analyzed by ATTOM.

Many of these so-called investors, not conscious whatsoever about a housing slowdown, nevertheless an economic downturn, are financing their flips at a record clip. The total dollar volume of financed home flips in 2Q was $8.4 billion, up 31.3% from $6.4 billion in 2Q18, to the highest level since 3Q06.

Forty-one percent of homes flipped in 2Q were financed, marginally higher QoQ, but down from 45.9% in 2Q18.

The hottest metropolitan statistical areas analyzed in the report with at least a million people were Salt Lake City, UT; Austin, TX; Dallas-Fort Worth, TX; San Antonio, TX, and Kansas City, MO.

Homes flipped in 2Q19 sold for an average of $220,000, with a gross flipping profit of $62,700. The 2Q figure was up from a gross flipping profit of $61,500 in 1Q, but down from $64,000 in 2Q18. These homes are staying on the market much longer than ever before, which is leading to margin compression of the flipper as buyers negotiate lower prices.

House flipping returns are plunging at a time when Robert Shiller sat down with Bloomberg earlier this month and dropped a bombshell that might have every flipper wetting their pants: “I wouldn’t be surprised if home prices started falling, and it could be accompanied by a recession.”

Nobel laureate Robert Shiller said he “wouldn’t be at all surprised” if U.S. house prices start to fall https://t.co/tqjfeGfo1l pic.twitter.com/mknbODH4Iq

— Bloomberg Economics (@economics) September 5, 2019

This article was sourced from ZeroHedge.com

Image credit: Pixabay

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Minds, Twitter, Steemit, and SoMee. Become an Activist Post Patron for as little as $1 per month.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "US House Flipping Returns Plunge To 8-Year Low"