If we consider the long term, it’s clear America’s economy and society have been declining for the average household for 50 years.

What if the “prosperity” of the past 50 years is mostly a statistical mirage for the bottom 80% of households? What if whatever real gains (adjusted for real-world loss of purchasing power) accrued only to the top of the wealth-power pyramid, those closest to financial and political power? What if the U.S. economy and society shifted from “everybody wins” to “winner takes all” or at best, “winner take most”?

These are not “what if”, they’re reality. The working class, which as I have recently noted, now comprises the entire working populace other than the upper-middle class Misplaced Pride: Most of the “Middle Class” Is Actually Working Class (June 14, 2019), has lost ground over the past 50 years, from 1969 to the present.

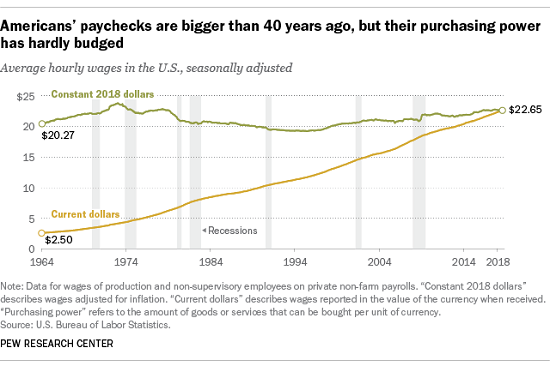

The keys to understanding the concealed crisis of decline are purchasing power relative to wages/earnings–how many goods and services can wages buy? For the average American household, wages have risen modestly while the purchasing power of those wages has plummeted.

Furthermore, the quality of goods and services has in many cases declined sharply, so that even if prices have dropped, what you get for your money has fallen even further, effectively reducing the purchasing power of your wages.

Case in point: appliances were once designed and built to last a generation or longer. Refrigerators, washers and dryers lasted for decades. Now the average appliance fails within a few years, and the electronic board–costing roughly a third of the entire appliance price–fails and must be replaced. With labor, the cost of the repair is so high, consumers often send the almost-new appliance to the landfill and buy a new (and soon to fail) appliance.

Net-net, low quality reduces purchasing power even if price has declined.

Then there’s the big-ticket items: rent, housing, college, healthcare. Anecdotally, I’ve been told a young engineer in Silicon Valley could earn $20,000 a year and rent a modest apartment for $200. Now the young engineer makes $100,000 but rent for the modest flat is $2,500 per month: wages rose five-fold but rent rose 12-fold.

This is a staggering loss of purchasing power.

As for college, tens of millions of students completed their university training with zero debt–student loan debt as we understand it today simply didn’t exist because it was unnecessary.

The scarcity value of that college diploma has fallen precipitously over the decades, rendering most degrees that aren’t part of artificial scarcity schemes essentially valueless.

As for healthcare: we now have $100,000 operations that work miracles on one side and people being bankrupted by costs on the other, and tens of thousands dying of opioid drugs promoted by the status quo as “safe” and non-addictive. Where metabolic disorders (lifestyle diseases such as diabesity) were once a relative rarity, now up to a third of the entire population is at risk of chronic lifestyle diseases that are difficult and costly to manage–but oh so profitable to those delivering the meds and care.

Bottom line: how much housing, higher education and well-being does the average wage buy now compared to decades past? Not much. The statistics are bleak: wages are basically unchanged from the high water mark 50 years ago, which coincidentally was also the high water mark of U.S. energy production until very recently. Adjusted for purchasing power and quality, the average paycheck buys far less than it did 50 years ago.

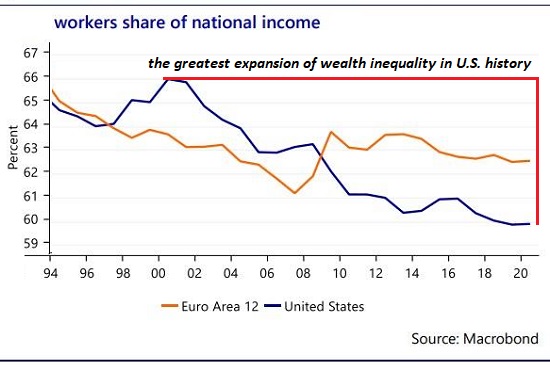

Wages’ share of the national income has plummeted since the last secular expansion of wages in the Internet boom of the late 1990s.

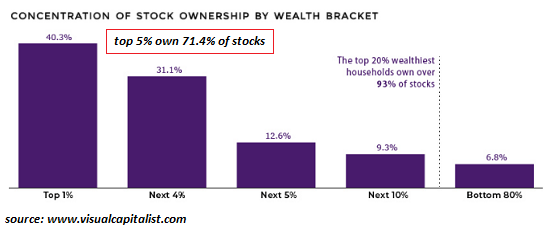

The average household’s ownership of productive capital, and thus of financial security, has declined. There’s fewer assets within reach and those that are in reach have been reduced to a casino of booms and busts that wipes out all but the most agile gamblers.

If we consider the long term (la longue duree), it’s clear America’s economy and society have been declining for the average household for 50 years. Nobody wants to admit this because it’s politically inconvenient, to say the least. What do we make of a society in which only the top 5% have prospered in terms of their earnings buying more goods and services?

Meanwhile, everyone else has compensated for the sharp decline in purchasing power by going ever deeper into debt while the nation has decayed into a landfill economy.

You can read more from Charles Hugh Smith at his blog Of Two Minds, where this article first appeared.

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 ebook, $12 print, $13.08 audiobook): Read the first section for free in PDF format.

My new mystery The Adventures of the Consulting Philosopher: The Disappearance of Drake is a ridiculously affordable $1.29 (Kindle) or $8.95 (print); read the first chapters for free (PDF)

My book Money and Work Unchained is now $6.95 for the Kindle ebook and $15 for the print edition. Read the first section for free in PDF format.

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com. New benefit for subscribers/patrons: a monthly Q&A where I respond to your questions/topics.

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Minds, Twitter, Steemit, and SoMee.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.