By Rory Hall

By Rory Hall

Dr Warren Coats, former Chief of the SDR with the title Assistant Director of the Monetary and Financial Systems Department at the IMF penned an article on a return to the gold standard in 2013 – A Hard Anchor for the Dollar. Not a classic gold standard, but an “updated version” of a gold standard that would allow for entities like the IMF, World Bank and BIS to stay involved and be part of the global banking system. This would allow these global banks to continue dictating monetary policy and continue to squash our freedoms and human rights.

Fractional reserve banking is a big part of the problem the Federal Reserve Note currently suffers. When a so-called bank, like Goldman Sachs or any of the Federal Reserve member banks, can simply state, for example, their books are 10 times greater than the reality, that is a major problem and allows for serious imbalances in the economy and the financial system. Eliminate fractional reserve banking and inflation would collapse and our economy would begin to improve almost overnight. The too big to jail banks would all collapse, which used to be called capitalism. When a privately owned company acts irresponsible and these banks are nothing more than another private company, like a neighborhood hardware store, plumbing company or auto repair shop, when they get themselves into financial trouble they should go bankrupt and not be “saved” by the people, the people’s taxes nor any other public means.

cartoon via The Burning Platform

cartoon via The Burning Platform

The greatest period of growth the world has ever seen was during the classic gold standard period between 1792 (Coinage Act was introduced) to 1934. The Federal Reserve, under Ben Bernanke, admitted to engineering the Great Depression, which in turn, is an admission of destroying the global economy and global financial system for personal gain. The hijacking of our economy and financial system by the Federal Reserve in 1913 set in motion 99% of the economic problems we are dealing with today. Eliminate the Federal Reserve and return the issuance of currency back to the people – Congress/U.S. Treasury – where it belongs according to the Constitution and our economy and financial system would have a better opportunity of returning to health instead of what we have today, which is nothing more than corruption, malfeasance and a stock market that is having a “front loaded wealth effect” , according to former Dallas Federal Reserve President, Richard Fisher. Full disclosure of the ESF (Exchange Stabilization Fund) and returning this currency back to the people and eliminating any and all laws, bills, acts, rules and/or regulations supporting the ESF would be another step in the right direction.

Dr. Coats states the price of the “anchor” – gold – was a weakness. Weakness for who? The economy was robust, growing and innovation between 1792 and 1934 was one of the largest expansions of global economies the world has ever seen. Not sure that I see this as a weakness.

Dr. Coats states Expanding the anchor from one commodity to 10 to 30 goods and services with collective stability relative to the goods and services people actually buy (e.g. the CPI index), would reduce this volatility.

The exact composition and amounts of the items in the valuation basket could be adjusted periodically just as the CPI basket is. ~Dr. Coats

This is another part of the overall problem – this allows for corruption, manipulation and banks to get their hands on our currency, the overall economy and financial systems. Gold and silver have served as money and currency for thousands of years and the banks and their minions have been attempting to manipulate the entire system for the past several hundred years. They have been successful, but the people are awakening to their deception.

Enter cryptocurrencies. This is a direct reflection of the people revolting against the current corrupt-to-the-core-system. People are willing to gamble with their future in order to move away from what the pirates at the Federal Reserve, European Central Bank and all the other Rothschild’s owned central banks have created. There are millions of people, around the world, willing to try something completely different that is seen as a way of taking back their freedom and human rights that have been stolen by the banks.

Enter cryptocurrencies. This is a direct reflection of the people revolting against the current corrupt-to-the-core-system. People are willing to gamble with their future in order to move away from what the pirates at the Federal Reserve, European Central Bank and all the other Rothschild’s owned central banks have created. There are millions of people, around the world, willing to try something completely different that is seen as a way of taking back their freedom and human rights that have been stolen by the banks.

Indirect redeemability – is another aspect of Dr. Coats’ paper that I completely disagree with.

Historically, gold and silver standards obliged the monetary authority to buy and sell its currency for actual gold or silver. If the dollar price of gold in the market were higher than its official price, people would buy gold at the central bank increasing its market supply and reducing the money supply until the market price came down again. These precious metals had to be stored and guarded at considerable cost. More importantly, taking large amounts of gold and silver off the market distorted their price by creating an artificial demand for them. A new gold standard would see the relative price of gold rising over time due to the increasing cost of discovery and extraction. The fixed dollar price of gold means that the dollar prices of everything else would fall (deflation). While the predictability of the value of money is one of its most important qualities, stability of its value, such as approximately zero inflation, is also desirable.

Indirect redeemability eliminates these shortcomings of the traditional gold standard. Indirect redeemability means that regulation of the money supply does not require transacting in the actual anchor goods or commodities. Assets of equal market value can be exchanged by the monetary authority when issuing or redeeming its currency. Market actors will still have an arbitrage profit incentive to keep the supply of money appropriate for its official value.

Dollars might be issued and redeemed against U.S. Treasury bills equal in value to the anchor bundle of goods (the valuation basket). If the market value of the goods in the basket were higher than one dollar, anyone could buy them more cheaply by redeeming dollars for them at the Fed. But such arbitrage works just as well when indirectly redeeming dollars for the basket using, for example, an equivalent value of U.S. treasury bills. If, for example, the basket cost $1.20 in the market, anyone could buy $1.20 worth of T-bills from the Fed for only one dollar. This arbitrage- induced contraction of the money supply would reduce prices in the market until a dollar’s value in the market was the same as its official valuation basket value. As the economy grew and the demand for money increased, this mechanism would increase the money supply as people sell their T-bills to the Fed for additional dollars.

Gold and silver are currently stored in Ft. Knox and FRBNY and I believe a couple of other Federal Reserve vaults. These vaults and cost are already on the books. Dr. Coats’ argument is assuming inflation would be the same as it is today – on a fast moving, upward trajectory – gold reigns in inflation due to the amount of gold coming to market each year – approximately 2-3% per annum. This is much more stable than the current 8-9% inflation and would be a stable number as long as miners continue mining gold. The necessary adjustments for inflation, cost of living adjustment, could be made – if it were necessary – for the upcoming fiscal year in Q4 of the current fiscal year as the cost of living inflation metric would be known – see classic gold standard years between 1792 and 1934.

Under the classic gold standard, inflation was not hurting anyone as it was already reined in with the stable price of gold for the entire 142-year span. Manipulating this current system that has only existed since 1971 – with lots of inflation, bubble economics and economic collapses – is no longer working for the people. It will continue to work brilliantly for the banks and corporations. If the banks and corporations wish to continue down this road of corruption, manipulation and theft the people will continue to devise ways of moving away from this type of system. As they say, the “Genie is out of the bottle.” In this case, the “Genie” is becoming educated to gold/silver, money/currency, cryptocurrencies and blockchain technology. If the banks and corporations wish to keep the people on their side, they should start acting like we matter. 2018 through 2020 are going to be banner years for the people. A return to Constitutional money and a complete elimination of fractional reserve banking and the Federal Reserve system would curb, but not stop, the paradigm shift that is beginning to unfold.

The United States could easily amend its monetary policy to incorporate the above features – a government defined value of the dollar as called for in Article 1 Section 8 of the U.S. Constitution and a market determined supply. The Federal Reserve would be restricted by law to passive currency board rules. All active purchases and sales of T-bills by the Fed (traditional open market operations) or lending to banks would be forbidden. It would buy and sell T-bills against dollars passively in response to market demand. During a five–year transition period it would be allowed to lend to banks against good collateral in order to allow banks time to adjust their operations and balance sheets to the new rules.

Were the people allowed a five-year transition period to “adjust” their books to new laws, rules, regulations or acts that were introduced by the banks – like the Federal Reserve Act in 1913? Absolutely not. The too big to jail banks were given a reprieve in 2008 and they have squandered the last decade participating in more manipulation, more corruption and more theft instead of getting their act together and doing the right thing. Let them fold and move to the dust bin of history where they should have went in 2008.

The gold standard was an international system for regulating the supply of money and thus prices in each country and between countries and provided a single world currency (via fixed exchange rates). Balance of trade and payments between countries was maintained (when central bank’s played by the rules) because deficit countries lost money (gold) to surplus countries, reducing prices in the former and increasing them in the latter. This led to a flourishing of trade between countries. This was a highly desirable feature for liberal market economies.

The United States could adopt the hard anchor currency board system described above on its own and others might follow by fixing their currencies to the dollar as in the past. The amendments to the historic gold standard system proposed above would significantly tighten the rules under which it would operate and strengthen the prospects of its survival. – Dr Coats

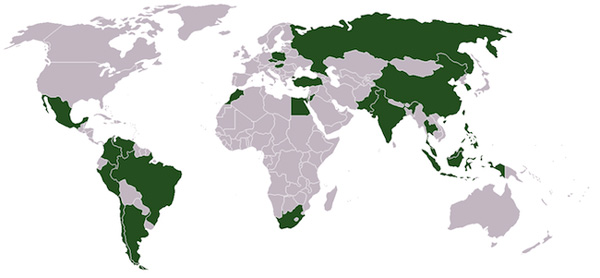

The green areas of the map below represent the nations that are currently working with China and Russia either individually or collectively. The economic alliances that are being formed, around the world, basically, do not include the nations that are vassals of the U.S. These nations are so dependent on the Federal Reserve Note, the “leaders” either believe they can not rise up or the corruption is so engrained into their system they refuse to rise up.

What is happening, right now, is a desire by Russia and China to reintroduce gold to the monetary system and completely eliminate the world reserve currency system from global trade, thus eliminating all leverage from the Federal Reserve Note and making it nothing more than just another bank note with zero monetary influence and impact on other currencies.

What is happening, right now, is a desire by Russia and China to reintroduce gold to the monetary system and completely eliminate the world reserve currency system from global trade, thus eliminating all leverage from the Federal Reserve Note and making it nothing more than just another bank note with zero monetary influence and impact on other currencies.

Look at Venezuela and the fact that Maduro is striking out on his own and is going to introduce a cryptocurrency backed with oil and gold. These are direct reflections – and revolts – against what the Western banking system has done to the world.

The world needs a gold standard and needs for the parasitic banking system to be eliminated. People the world over are beginning to stand up and demand change. I just hope we don’t move out of the frying pan and into the fire.

Rory Hall’s site is The Daily Coin, where this article first appeared. Beginning in 1987 Rory has written over 1,000 articles and produced more than 300 videos on topics ranging from the precious metals market, economic and monetary policies, preparedness as well as geopolitical events. His articles have been published by Zerohedge, SHTFPlan, Sprott Money, GoldSilver, Silver Doctors, SGTReport, and a great many more. Rory was a producer and daily contributor at SGTReport between 2012 and 2014. He has interviewed experts such as Dr. Paul Craig Roberts, Dr. Marc Faber, Eric Sprott, Gerald Celente and Peter Schiff, to name but a few. Don’t forget to visit The Daily Coin and Shadow of Truth YouTube channels to enjoy original videos and some of the best economic, precious metals, geopolitical and preparedness news from around the world.

Image Credit: Pixabay

Get rid of the dollar – along with the phony bank that prints it – and start a real US currency that can’t bribe the world into wars and misery. Of course this would mean the collapse of the America’s but if Russia could make a comeback from the Soviet fall, so can the Americans. Putin, like him or not , could certainly teach the Americans a thing or two about – How to get America back on the righteous road – again.

Perhaps. And I like your idea. But, the anglo-american hierarchy will never allow that to happen. They will sell all of us out, as is currently happening with selling off companies, shares, and land to foreign entities, to stay in global power, or regional power.

The treasonous Woodrow Wilson gave up the keys of the unFed B.S. bank of the U.S. to the unholy goat worshipers on 12/21/1913.

Pump and dump every 7 years since.

End the Fed and a thousand years of peace and prosperity will commence.

I completely agree. Every decade there is a crash-recession. Created as an excuse because the criminals have already stolen the wealth.

I still believe crypto currencies are just another psyop to get people to move in the electronic banking age and the internet of things. Going to gold and silver standards: since when has there ever been posterity? Never. Even if a State makes public the gold and silver mines among all other natural resources, you will still have those whom wish for control of these resources, cuz, well, psychopaths and the criminally insane. Every government/state is a kakistocracy: worse elements of society running the society. So, no matter how you cut it, there will be corruption and austerity. Why stop at just banishing the private banking system and banish all currencies? Currency is just how kakistocracies controls the masses. If we are moving into the space age, are we as a planet going to trade currencies with other planets? Really? How would that work? Stock you ships with gold and silver, or zeroes on a computer screen, or stacks of pieces of paper? Gold and silver have intrinsic value in able to be used in electronics and other uses, but I don’t see us trading it as currency with advanced races out there. Just using that as an example, the only value precious metals have as currency is all in our heads.

Yes why should the ” too big to jail banks” be bailed out by the people that they have bankrupted with their corruption? Where is the bail out for the people who have been made homeless by these criminals? Where is their bail out? Hmmm?

Instead of criminalising homelessness because the perpetrators can’t stand to see the results of their evil works how about letting these disgusting criminal banks be homeless & bail out the people! Isn’t it supposed to be a government by the people for the people? It NOT a government for the banks for the banks!

Jail these criminals & make them wear their disgrace publically!!!!!

This is a simplistic view of the gold standard and does not acknowledge the boom and bust cycles that existed when it was in place.

can you please provide a trend line that backs up your claim? I believe what you will see is something fairly consistent with a couple short-term inflationary burst – usually associated with war – but for most of the period you will see steady monetary flow.

the bubble economics we have suffered under from 1989 to present – forget everything between 1913 and 1989 – has been for more volatile than the period from 1792 to 1913 – that’s comparing a 29 year cycle to a 142 year cycle.