You don’t have to be survivalist or a doomsdayer to recognize the practicality in having some food stored away for a rainy day. In fact, it’s simply becoming common sense to have a certain amount of bulk food storage in your house.

But these days, with record droughts ravaging the bread basket of America coupled with runaway money printing by the Fed, food inflation is creating a dangerous scenario but also a fantastic investment opportunity for average folks.

During times of economic uncertainty it can be especially difficult to determine a safe place to protect your savings. Countless financial advisers offer advice on asset protection and other ways to keep your nest egg performing slightly above inflation. However, many of these strategies involve paper investments that come with risks.

People in the know suggest tangible assets like precious metals. But if you’re like the overwhelming majority of Americans living week-to-week, acquiring gold and silver can seem daunting. Although it’s definitely worth accumulating some precious metals when you have expendable income, food may prove to be a much better investment.

Food is far easier to find at good values than precious metals and is more practical to accumulate in bulk. What’s more, you don’t have to be a sophisticated commodities trader or even have a brokerage account to benefit from food investments. Anyone can buy extra food each time they go to the supermarket and create a plan to rotate it properly to the dinner table.

Food also has the added value of being immediately usable, where metals must be traded for human necessities. Investing in food is not about taking advantage of a low-priced asset for the purpose of selling it at higher prices later on. It is about offsetting your future cost of living by being savvy enough to recognize the trend and plan appropriately.

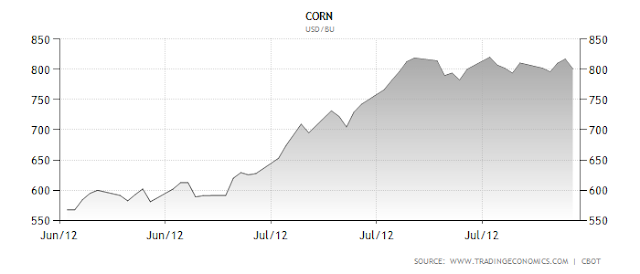

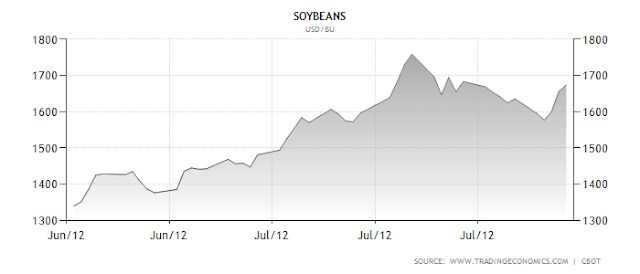

The trend for rising food prices in the second half of 2012 and beyond is undeniable.

Why Invest in Food in 2012

First, it’s important to understand that even though the prices of food commodities fluctuate, the retail cost of food rarely comes down. Sure, there are temporary sales, but over the long haul prices only go in one direction — up.

Over the last few years, the world has experienced dramatic spikes in food prices. These increases are typically blamed on harsh weather conditions that decrease crop yields and provide the excuse for commodity speculators to drive food prices up. As recently as 2010, blistering heat waves in Russia sent food prices to new highs.

In 2008, the life blood of industrial farming — oil — hit an all time high of $147 per barrel which caused rice to triple in 6 months, and other food commodities to more than double during the same time. Then, of course, there’s basic supply and demand; as the world’s population continues to grow and fertile soil is depleted exponentially, prices will naturally rise. Finally, others recognize persistent food inflation to be a simple effect of the monetary system’s inherent deflation of currency.

So, between extreme weather, energy prices, supply and demand, commodity speculators and assured currency devaluation, it’s a safe bet that food prices will continue climbing. Whatever the case may be, wages or paper investments never seem to rise as quickly as the cost of necessities like food.

So, between extreme weather, energy prices, supply and demand, commodity speculators and assured currency devaluation, it’s a safe bet that food prices will continue climbing. Whatever the case may be, wages or paper investments never seem to rise as quickly as the cost of necessities like food.

The perfect storm of these factors seems to be forming in the second half of 2012, making investing in food a sure thing. The worst drought in 50 years has struck America this summer creating a near panic in farmers and those who measure crop yields. The drought pushed farmers to abandon fields larger than some European countries and forced the USDA to decrease their corn production projections by 2.2 billion bushels. Soybeans aren’t faring much better, as 47% of the fields are considered to be ‘poor’ or ‘very poor’.

There are very real implications for the world with this level of shortages coming out of the United States, not least being what will happen to prices as the result of speculators banking on this data. “We’re going to see very high prices,” Joseph Glauber, the USDA’s chief economist, told the Financial Times.

If we combine this once-in-a-generation epic drought with the mounting tensions in oil-rich regions in the Middle East, an exploding population of Asians with the means to buy imported foods, and the Federal Reserve flirting with making quantitative easing (money printing to cover budget shortfalls) a permanent policy, the perfect storm may be upon us.

Indeed, food commodity prices have already spiked as a result of the current drought. Corn and soybean prices are up about 40% since June, and are only expected to increase further:

|

| Chart Source |

|

| Chart Source |

Luckily it takes a bit of time before commodity prices begin to affect grocery store prices. However, it is already beginning to hit Main Street in the pocketbook. Therefore, now is the time to put together your household investment plan for bulk food storage.

Consider if retail food costs rise by 40% or more over the next few months, you will only be able to buy 6 units of something that you could have stored 10 units of for the same price. Imagine you have $1000 in your savings account versus $1000 worth of food stored in your personal food bank. The future value of your dollar bank account for buying food essentials is $600, while the future value of your food bank is $1400. That is an 80% swing in real terms.

This can be the difference in literally starving or living in relative comfort through very difficult times that are sure to affect the majority of the world’s population.

Stay tuned over the next days and weeks as we’ll be outlining detailed bulk food storage strategies for how to take advantage of this dismal situation and protect your family and your savings.

For now there are a few easy ways to stock up on storable foods that everyone should be investing in.

Read other articles by Activist Post HERE

I’m snagging your quote/expression for personal reference/use. I will honor and give Ponce credit for it. Similar to the BSA motto, “Always prepared”/”Be prepared” yet your version more aptly conveys deeper contextual meaning. I like that better as for me contextual meaning is of value, it is something the learning disabled struggle with at times. 🙂