At a time when the power grid is being destroyed as unreliable alternative energy replaces plentiful coal and natural gas, the massive power consumption by humongous AI data centers is quickly becoming a Black Swan event for American consumers. Trump recently stated that AI will require the doubling of energy production in America. This is not possible with the current war against “fossil fuels.” Period.

Some consumers are already experiencing larger monthly utility bills than their rent or house payments. Lawmakers are so far behind the curve of AI that they can’t protect us.

The AI industry will play the “greater good” card on consumers, telling us that we need to sacrifice in the short term so they can use AI to restructure/reform society. — Technocracy News & Trends Editor Patrick Wood

Goldman Says Mid-Atlantic Power Prices “Finally Caught Up To AI Data Center Load Growth Story”

By Tyler Durden via ZeroHedge

Marylanders and residents in surrounding states should brace for rising power bills due to capacity constraints on the regional power grid and the increasing peak load from new AI data centers (read: here). This combination creates a perfect storm of continued utility bill inflation, which will only pressure cash-strapped households in the years ahead.

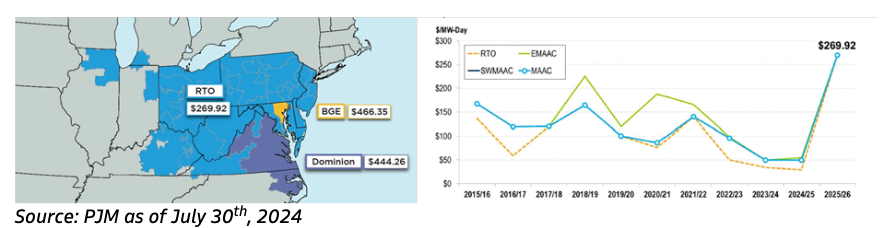

On Friday, Goldman published a note about Tuesday’s PJM Interconnection power capacity auction for the 2025-26 planning year (June 1st, 2025, to May 31st, 2026). The note revealed a massive surge in capacity prices:

“The price across the RTO (see map below) was $269.92/MW- day. This is more than an 800 percent increase from the most recent auction (which cleared at $28.92/MW-day), and also a new record (the previous high was $174.11/MW-day for the 2010- 2011 planning year).”

“In addition to procuring the required capacity across the PJM RTO region, PJM’s auction also sets targets for specific zones or LDAs (Locational Deliverability Areas) based on transmission limitations. The auction failed to procure the required level of capacity in two zones (Dominion or “DOM” and Baltimore Gas and Electric or “BGE “) which cleared at the applicable caps of $444.26/MW-day (DOM) and $466.35/MW-day (BGE). PJM has not yet published the extent of the shortfall in the two zones.”

The critical point from the report:

“After a series of auction delays and relatively low clears (see chart below), PJM capacity prices appear to have finally caught up with the generative AI data center load growth story that has been central to parts of PJM.”

Goldman warned that more power capacity would be needed for grid stability. However, any new capacity could take years to come online, which essentially means, as the analysts point out, “higher prices are here to stay.”

“All else equal, the market expects the next few auctions to all clear at more robust prices, especially since the signal is clear – PJM needs more reliable capacity to manage the potential demand growth. Given the lead time for new-build capacity (4-5 years given current market dynamics and supply chain issues) the expectation is that generally higher capacity prices are here to stay.”

Goldman noted:

“The higher prices are expected to delay retirements, potentially spur more focus on coal-to-gas conversion for units that were at risk of retirement due to carbon related costs, and to also incentivize new construction.”

Meanwhile, as we’ve previously noted, “Maryland “Can’t Import Itself Out Of Energy Crisis” Amid Urgent Need To Boost In-State Power Generation …“

Let’s remember Maryland’s power crisis stems from ‘green’ policies pushed by progressive lawmakers in Annapolis who have banned any new fossil fuel power generation in the state. With AI data centers coming online, the result in the next 3-5 years will be crushing power bill costs to everyday voters.

Maryland voters need to make leftist lawmakers in Annapolis accountable for failed green policies that sends power costs higher.

California Power Bills Are Soaring

by Tsvetana Paraskova via OilPrice

Consumers in California have seen their electricity bills surge in recent years and double over the past decade as utilities are investing more in wildfire prevention and transmission lines to accommodate growing renewable energy output.

As these utilities invest billions of U.S. dollars to make the grid more resilient, they pass the higher spending on to consumers.

So California now has the second-highest average electricity bill in the United States, second only to Hawaii.

“Untenable” Surge

California is looking to rapidly shift away from fossil fuels and make its grid more resilient, but these efforts show the other side of the greening of the grid—power generation costs may be plunging, but transmission and distribution costs are rising, leading to higher spending from utilities.

These increased expenditures are passed on to consumers by the investor-owned utilities Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric. As a result, electricity bills in California have risen so much in recent years that in some places, the power bill exceeds the cost of rent, The Wall Street Journal reports in a featured article.

The surge in bills has been “untenable,” according to the consumer advocate’s office at California’s utilities regulator.

In its latest 2024 Q2 Electric Rates Report last month, the Public Advocates Office tracked residential electric rate changes across Pacific Gas and Electric (PG&E), San Diego Gas & Electric (SDG&E), and Southern California Edison (SCE) service territories through July 1, 2024.

The report found that over the last few years, California’s electric bills are generally rising due to higher electricity use from things such as air conditioning, and higher overall electricity prices.

Since January 2014, residential average rates for the PG&E service area have jumped by 110%, those of SCE have surged by 90%, and SDG&E rates have soared by 82%.

The primary statewide drivers of soaring rates have been investments in wildfire mitigation, transmission and distribution investments, and rooftop solar incentives or the so-called net energy metering, the Public Advocates Office said.

Overall, residential electricity rates have increased substantially since 2014, surpassing inflation, it noted.

It couldn’t be surprising then that nearly 1 in 5 households are behind on their energy bills, according to the office. A total of 18.4% of the customers of the three investor-owned utilities are in arrears in their energy bills.

Changes in Charging for Electricity

This year, California has changed the way utilities charge for electricity and is transitioning from net energy metering to net billing tariff for residential solar projects. These regulatory changes have hit residential solar installations and are set to change the way power bills are formed starting next year.

The move to the net billing tariff in California dragged down the total U.S. residential solar market, which saw in the second quarter of 2024 its lowest quarter since Q1 2022 at 1.3 GWdc, reflecting a 25% decline year-over-year and 18% quarter-over-quarter.

“While slowdowns are occurring nationwide, these declines were heavily influenced by California, where quarterly installations have shrunk for the last two quarters as NEM 2.0 projects are built out and the state transitions to the net billing tariff,” the Solar Energy Industries Association (SEIA) said in its latest quarterly report.

In another significant change, California’s utilities will charge from next year or 2026 a flat monthly fee of up to $24.15 on all customers while reducing the charges imposed per kilowatt of electricity used.

The California Public Utilities Commission (CPUC) says that the new billing structure “lowers overall electricity bills on average for lower-income households and those living in regions most impacted by extreme weather events, while accelerating California’s clean energy transition by making electrification more affordable for all.”

The usage rate for electricity will be reduced by 5 to 7 cents per kilowatt-hour for all residential customers, which makes it more affordable for everyone to electrify homes and vehicles, regardless of income or location, because the price of charging an electric vehicle or running a heat pump is lower.

However, critics of the new billing structure have said \ it will hurt customers who live in small homes and have relatively small electricity use as the lower per-kWh rate would not offset the new flat fee.

It remains to be seen how the new billing structure will affect California customers and whether it will lead to the expected mass electrification of homes.

A total of 78% of Americans are concerned about their rising energy bills, an exclusive CNET Money survey has shown. Around 80% of U.S. adults in all regions, including the Northwest, Midwest, South, and West, said that their finances have been impacted by growing home energy costs, according to the survey.

California leads in U.S. solar and battery installations, but the cost of bringing that power generation to consumers has soared with the need to expand, upgrade, and protect the power grid.

Sourced from Technocracy News & Trends

Image: Pacific Northwest National Laboratory

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Telegram, HIVE, Minds, MeWe, Twitter – X and Gab.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "AI Black Swan: Power Prices Skyrocket On East And West Coasts"