By Tyler Durden

By Tyler Durden

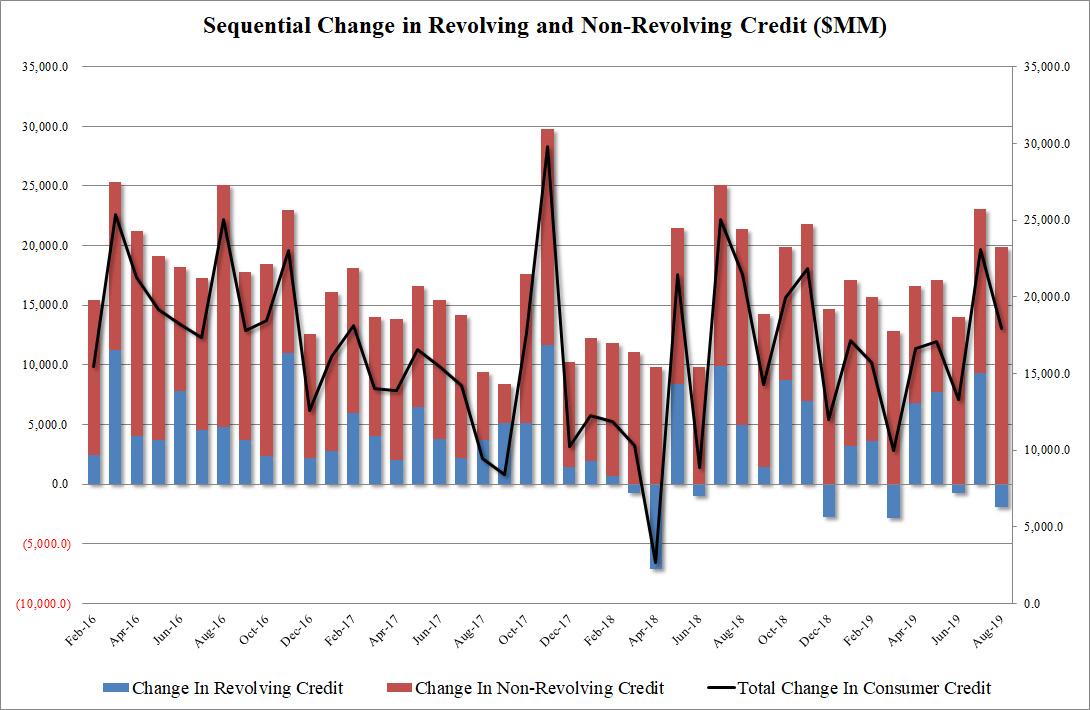

While the total increase in US consumer credit in August was hardly a major outlier, rising by $17.9BN, below last month’s $23.05BN if above expectations for a $15.25BN print, and pushing the total number to a new record high of $4.14 trillion, the components of the overall number were surprising.

The first surprise was the revolving, or credit card, debt, which after surging by almost $10BN in July, the biggest one month increase since 2017, shrank by $1.9BN in August as consumers paid down their credit cards. This was the biggest monthly drop since March, and only the 8th monthly drop in this series in the past 7 years.

See: 177 Different Ways to Generate Extra Income

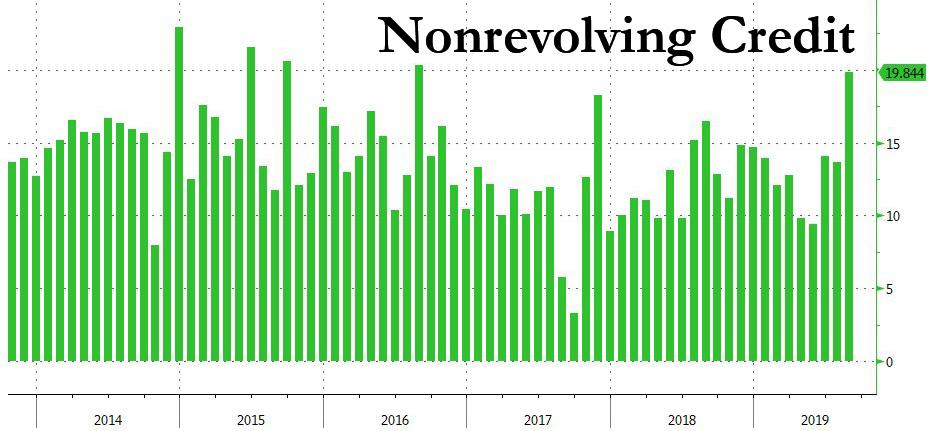

Finally, putting these numbers in context, there were $1.606 trillion in student loans as of June 30, with $1.2 trillion due under auto loans.

And while we don’t expect any of these numbers go down at any point in the future thanks to record low interest rates which incentivize US consumers to take out even more debt, the bigger question is why was America’s chronically strong consumer so aggressive in paying down credit card debt in August, and is this an indication that this biggest force in the US economy, which accounts for 70% of GDP, is starting to tap out.

This article was sourced from ZeroHedge.com

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Minds, Twitter, Steemit, and SoMee. Become an Activist Post Patron for as little as $1 per month.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Be the first to comment on "Student, Car Loans Surge Most In Three Years"